AppLovin

AppLovin

app

$0.10

0.12%

101%

IBD Stock Analysis

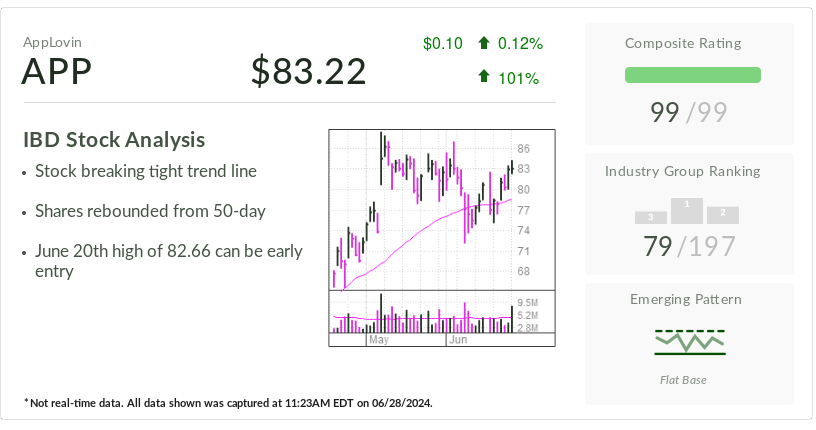

- Stock breaking narrow trend line

- 50 days since the return of shares.

- A high initial entry of 82.66 is likely on June 20.

Industry Group Rankings

The emerging pattern

Flat base

* Not real time data. All data shown was obtained on 06/28/2024 at 11:23AM EDT.

AppLovin ( APP ) IBD is the stock of the day as the mobile app marketing platform looks to capitalize on its investment in artificial intelligence. AppLovin stock is also near a reasonable buy point.

↑

x

How to Pick Great Stocks: Look at the Earnings Line

“We see AppLovin's AI investments, particularly the launch of the Axon 2.0 targeting algorithm, as a sustainable advantage that will take years for competitors to replicate,” Jefferies analyst James Haney said in a client note on Sunday. may seem.” Heaney buys AppLovin stock with a price target of 105.

In the stock market today, AppLovin stock closed up a share at 83.22. IBD MarketSurge charts show that AppLovin stock is in a flat base with a buy point of 88.50.

However, aggressive investors can use the June 20 high of 82.66 as an initial entry, according to IBD analysis. It hit that level on Thursday, breaking a tight trendline as it rebounded from its 50-day moving average line, a key support level.

AppLovin stock up after Q1 report

AppLovin's official buy point of 88.50 is at a more than two-year high. It reached that price after the Palo Alto, California-based company reported first-quarter results on May 8.

AppLovin smashed Wall Street targets for the quarter ending in March and gave higher guidance for the current period. It earned 67 cents a share, versus a loss of a penny a share a year earlier. Sales rose 48 percent to $1.06 billion. Analysts polled by FactSet had expected Q1 earnings of 57 cents on sales of $974 million.

For the current quarter, AppLovin forecast revenue of $1.06 billion to $1.08 billion. The $1.07 billion midpoint was above Wall Street's second-quarter target of $1.01 billion.

AppLovin's software platform enables app developers to market, monetize and analyze their apps. The company also makes mobile games such as “Bingo Story,” “Game of War” and “Solitaire Cruise.”

Axon 2.0 is ahead of the competition.

Haney says AppLovin's Axon 2.0 has proven its value to users.

“Over the past year, AppLovin's release of Axon 2.0 has significantly increased the performance of mobile app advertisers,” he said. “Perhaps the most impressive metric is the 87% year-over-year increase in app install volume in Q1, indicating that AppLovin's platform is nearly twice as effective as it was a year ago.”

AppLovin launched Axon 2.0 in early 2023. The ad engine leverages predictive modeling to help mobile game advertisers buy the right ad impression at the right price.

“We believe Axon 2.0's AI-based ad platform is increasing content share,” said Haney.

AppLovin executives say the company's ongoing improvements to Axon 2.0 “should create a sustainable advantage that would take significant time and resources for any competitor to catch up,” Haney said.

AppLovin stock ranks first among 37 stocks in IBD's Computer Software-Specialized Enterprise industry group. According to IBD Stock Checkup, it has the best possible IBD Composite Rating of 99.

Additionally, AppLovin stock is on the IBD Tech Leaders list.

Follow Patrick Seitz at X, first on Twitter, at @IBD_PSeitz For more stories on consumer technology, software and semiconductor stocks.

You may also like:

Apple is poised to lead the consumer AI market, analysts say.

The debate follows a recent drop in Nvidia stock value.

Chip gear stock surges on Micron's capex plans

Market Surge: Research, Charts, Data & Coaching All in One Place

See the stock on the list of leaders near the point of purchase