Bets on artificial intelligence (AI) are driving markets in the first half of 2024. Big tech companies and investors don't want to be left behind in a technological race that some compare to the advent of the Internet or the steam engine. . But the current winner of this feverish dash is Nvidia, a company that specializes in developing the chips needed to train AI systems.

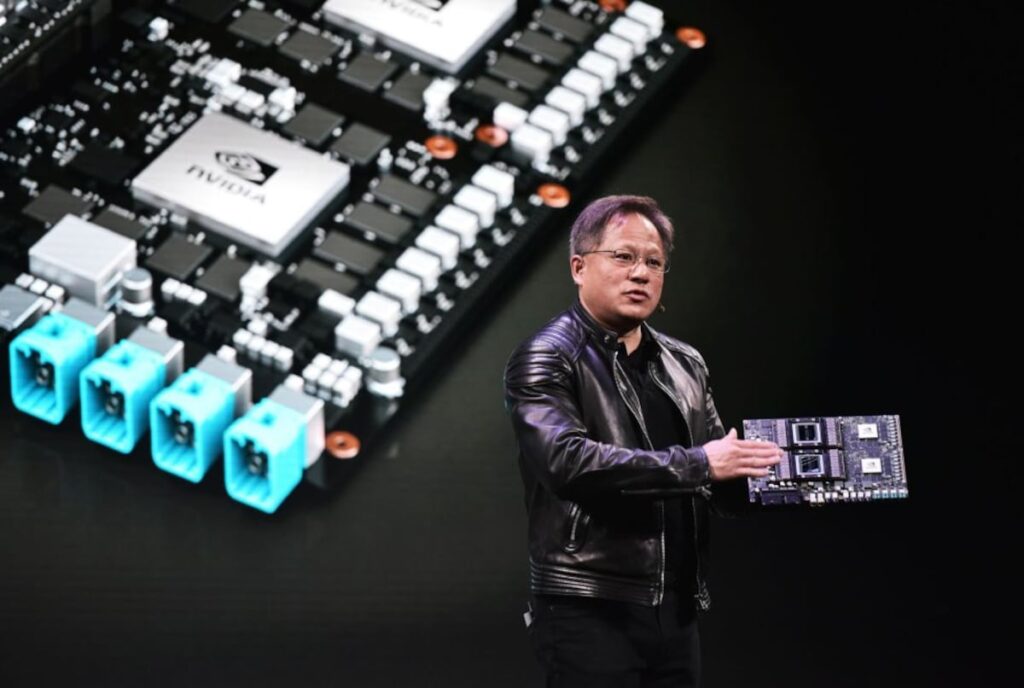

Headed by Jensen Huang and founded 33 years ago, Nvidia has broken more than a few records: it has led the S&P 500 by tripling its value in the past 12 months, trailing only Microsoft or Apple. It has become the most valuable company in the world. , over $3.2 trillion. Since the first ChatGPT model was launched in late November 2022 – the trigger for the current AI fever – Nvidia's value has increased by 700%.

But it's not just Nvidia that's rising in value. Big tech companies are going all-out to train their AI models, and they're getting the stock market's blessing in doing so. Microsoft is up 38 percent over the past 12 months, while Google's parent company Alphabet is up 57 percent. However, this trend has not been unique to the United States. European stock exchanges boast their Nvidia equivalent: Dutch giant ASML, which makes the machinery on which microchips are printed, has been crowned the most important company in European markets after overtaking France. LVMH. And in Asia, Taiwan's TSMC aspires to join the $1 trillion club by 2024 after its stock market jumped 170% in the first half of 2024, approaching $950 billion in investments.

Investors have backed a technology that, without being new, is creating language and images, and whose growth is in everything from pharmaceuticals to advertising thanks to hyper-personalization, to technology and computer programming. It promises to bring revolution. oil industry. However, as big tech companies break weekly capitalization records, the market is also expressing doubts: will this technology ever turn into corporate profits, or the great AI rally of the 2000s dot-com bubble? Is there a new version?

During this era, the emergence of the Internet and the proliferation of websites was destined to revolutionize everything. Even if they did, the timing of the economy is not the timing of the markets. Consequently, before the Great Change, technology stocks sank and thousands of projects, including some large ones, struggled to survive. A well-remembered example is Cisco, a maker of equipment for deploying and connecting the Internet, which has been favored by large third-party investments — like Nvidia. Cisco shares went from $5 in 1997 to $77 in 2000 to just $13 in 2002. They are now at $46.

NewStreet Research analyst Pierre Ferrago downgraded Nvidia's price predictions on Friday, July 5, arguing that its share price has already peaked. “Further increases would only materialize in a bullish scenario, where the outlook beyond 2025 increases materially, and we're not yet convinced that such a scenario will play out,” he tells Bloomberg. But hope seems to prevail. About 90 percent of analysts tracked by Bloomberg recommend buying the shares. “The results will take time, but they will come,” explains Flavio Muse, head of technology investments at Andromeda Capital. He believes that it is unlikely that 2024 will see the technology reach its full potential and deliver the long-awaited return.

Companies are currently rushing their orders for specialty chips to ensure they're on the transformation train, and their main supplier is Nvidia. Based in Santa Clara, California, the company first established itself as a leading manufacturer of graphics cards (GPUs) for video games. Over the years, these chips have proven to be the most efficient for the type of work required to train neural networks, which is the core of AI, thanks to the fact that they can perform multiple operations in parallel, unlike typical processors. can provide, known as CPUs. The company had unwittingly turned into a golden goose. Since then, Nvidia has been perfecting its products with AI in mind, and orders have been skyrocketing. In the first quarter of the year, the company's turnover grew 262%, following sales of $26,044 million. And profits rose from $2,043 million to $14,881 million, an increase of 628%.

Fueling the feverish demand are buyers who are members of the Magnificent Seven club — Microsoft, Apple and Amazon — who need the processing power of Nvidia's GPUs to build their AI models on massive amounts of data. This explosive demand is the basis of Nvidia's stock market stardom. However, the big tech hasn't been the only sector riding the gravy train. AMD, which also designs graphics cards, is up 18 percent so far this year, and Qualcomm, which makes chips for cell phones, is up 45 percent. Taiwan's TSMC, a semiconductor manufacturing leader, has also managed to gain 70% in the stock market while, in Europe, ASML has gained 50% this year, year-to-date.

Danny Fish, technology portfolio manager at Johns Henderson, says the existence of internet giants is vital to the continued development of AI technology. “They are the only companies that have the financial capacity and infrastructure to deploy artificial intelligence capabilities,” he says. The UBS analyst pigeonholes Nvidia and its rivals in what he calls the AI facilitation stage, which ranges from semiconductor design to chip design. “Investment in companies at this stage is recommended,” says the Swiss bank's investment team, arguing that “while there is a risk that overcapacity could lead to volatility.” , this segment currently offers excellent scope for reinvestment and reasonable pricing.”

According to these experts, the other two stages of the AI value chain are intelligence and application. These phases are commanded by companies that develop AI models such as Open AI (phase two) and those that develop AI for specific sectors such as cyber security and financial technology (phase three). For now, UBS believes it is safer to bet on the first part of the chain, namely facilitation, as it offers “stronger competitive positioning, better reinvestment margins and reasonable prices”.

Muñoz from Andromeda Capital, however, points out that it's important to look at other stocks participating in this ecosystem that have tremendous growth potential. These include memory manufacturers for data center operations, such as South Korea's SK Hynix and US-based Micron Technology; Network infrastructure providers such as Broadcom and Cisco as well as software firms and cybersecurity system providers such as Confluent and Snowflake.

A storm on the horizon

There are other managers, such as David Izcona, chief economist at Becca Finance, who warn that walls could be erected to slow the growth of the entire sector. He pointed out that the lack of solid investment and the emergence of competitors are the main risks during the first part of the year. Matthew Bullock, chief strategy officer at Janus Henderson, added that AI in its true form is a fairly small market and there are very few companies that generate the majority of their revenue from it.

In fact, the Magnificent Seven alone accounted for 60% of the S&P 500's total return this year. On average, S&P 500 stocks have gained 4.1% this year, while the overall index has climbed 14.5%. According to the Wall Street Journal, the imbalance is the largest since at least 1900. Muñoz explains that many investors are waiting for the next move by the US Federal Reserve, which was able to make up to three rate cuts last year, “but now it looks like it's not going to be one. “

Azcona believes that growth will moderate in the second half of 2024. Political uncertainty in the US and interest rate cuts due to elections, as well as a possible slowdown in consumption and a rise in unemployment, lead him to believe that the rally experienced in the first part of the year will continue in the coming months. It will be difficult to replicate.

Sign up Subscribe to our weekly newsletter to receive more English-language news coverage from the EL PAÍS USA edition