The global race to build the powerful computer chips needed for the next generation of artificial intelligence (AI) tools could have major implications for global politics and security.

The US is currently leading the design race for these chips, also known as semiconductors. But most of the manufacturing is done in Taiwan. US$5 trillion to US$7 trillion (£3.9 trillion to £5.5 trillion) to develop more powerful chips for the next generation of AI platforms, according to Sam Altman, CEO of OpenAI, the developer of Chat GPT. The call for investment has fueled the debate. .

The amount Altman is asking for is more than the chip industry has spent since its inception. Whatever the facts about these numbers, the overall AI market estimates are mind-blowing. Data analytics company Global Data predicts that the market will be worth US$909 billion by 2030.

Not surprisingly, in the past two years, the US, China, Japan and several European countries have increased their budget allocations and taken steps to secure or retain their share of the chip industry. China is developing rapidly and is investing hundreds of billions in subsidies over the next decade to build its manufacturing supply chain, including for next-generation AI.

Subsidy seems to be the preferred strategy for Germany as well. The UK government has announced plans to invest £100 million to help regulators and universities tackle the challenges of artificial intelligence.

Economic historian Chris Miller, author of the book Chip Wars, has discussed how powerful chips have become a “strategic commodity” on the global geopolitical stage.

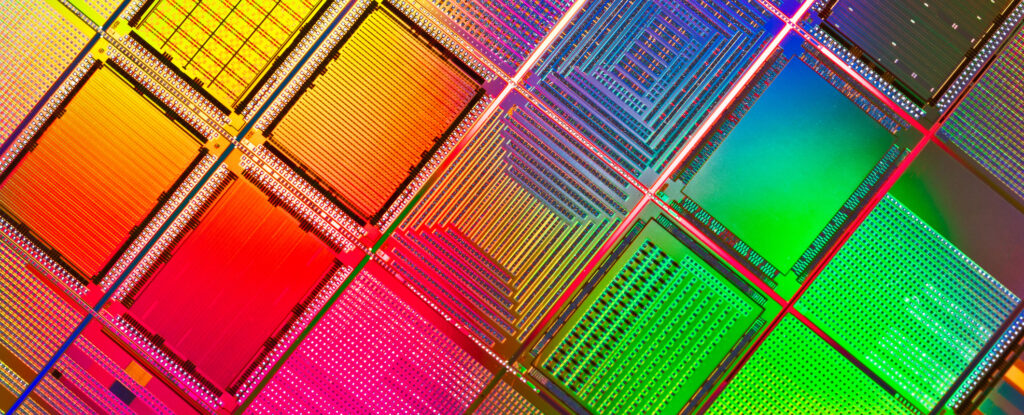

Despite efforts by many countries to invest in the future of chips, the variety needed for AI systems is currently lacking. Miller recently explained that 90 percent of the chips used to train or improve AI systems are developed by just one company.

That company is Taiwan Semiconductor Manufacturing Company (TSMC). Taiwan’s dominance in the chip-making industry is notable because the island is also at the center of tensions between China and the United States.

Taiwan has been independent for most of the mid-20th century. However, Beijing believes it should be reunited with the rest of China, and US legislation has called for Washington to help defend Taiwan if it is attacked. What will happen to the chip industry under such a scenario is unclear, but it is clearly a focus of global concern.

Supply chain disruptions in chip manufacturing have the potential to bring entire industries to a standstill. Access to raw materials such as rare earth metals used in computer chips has also proved to be a significant barrier. For example, China controls 60 percent of gallium metal production and 80 percent of global germanium production. Both of these are important raw materials used in chip manufacturing.

And there are other, lesser-known obstacles. A process called extreme ultraviolet (EUV) lithography is crucial to the ability to make computer chips smaller and smaller – and therefore more powerful. A single company in the Netherlands, ASML, is the sole manufacturer of EUV systems for chip production.

However, chip factories are increasingly being rebuilt outside of Asia – which has the potential to reduce over-reliance on certain supply chains. Plants are being subsidized to the tune of US$43 billion in the US and US$53 billion in Europe.

For example, Taiwanese semiconductor manufacturer TSMC plans to build a multibillion-dollar facility in Arizona. When it opens, that factory won’t produce the most advanced chips currently possible to make, many of which are still manufactured in Taiwan.

Shifting chip production out of Taiwan could reduce the risk of global supply in the event of a manufacturing disruption. But this process can take years to have meaningful effects. It is perhaps not surprising that, for the first time, this year’s Munich Security Conference created a chapter devoted to technology as a global security issue, with a discussion on the role of computer chips.

Broader issues

Of course, the demand for chips to fuel AI development isn’t the only way artificial intelligence will have a major impact on geopolitics and global security. The proliferation of misinformation and disinformation online has transformed politics in recent years by amplifying biases on both sides of the debate.

We have seen it during the Brexit campaign, during the US presidential election and more recently during the Gaza conflict. AI can be the ultimate amplifier of misinformation. Take, for example, deepfakes – AI-manipulated videos, audio or photos of public figures. It can easily fool people into thinking that a major political candidate has said something they didn’t.

As a sign of the growing importance of this technology, at the 2024 Munich Security Conference, 20 of the world’s largest tech companies launched something called the “Tech Accord”. In it, they pledged to contribute to building tools to spot, label and debunk deepfakes.

But should such important matters be left to the tech companies to police? Mechanisms such as the EU’s Digital Services Act, the UK’s Online Safety Bill, as well as a framework for regulating AI itself, should help. But it remains to be seen how they can influence the matter.

The issues raised by the chip industry and the increased demand due to AI development are just one way that AI is driving global change. But it remains a very important thing. National leaders and officials should not underestimate the influence of AI. Its potential to redefine geopolitics and global security may exceed our ability to predict and plan for the changes.

Kirk Chang, Professor of Management and Technology, University of East London and Alina Vadova, Director of the Business Advice Center for Postgraduate Students at UEL, Ambassador of the Center for Innovation, Management and Enterprise, University of East London.

This article is republished from The Conversation under a Creative Commons license. Read the original article.