As of the time of writing, the Worldwide Developers Conference on June 10, Apple Inc. (NASDAQ:AAPL) has added $297 billion in market cap, once again surpassing $3.20 trillion, regaining its position as the world's largest company, though still Microsoft (NASDAQ: MSFT) and is very close to Nvidia (NASDAQ:NVDA).

Apple has achieved an incredible milestone by announcing new features for its products, changing the outlook and going from one of the companies not on top of the artificial intelligence trend to a company that is making the most of it. To go. Most importantly, it has the power to spur growth, making it even more profitable and strengthening its ecosystem moat.

On the other hand, in this context, it is also important to analyze the company's margin of safety in view of all the excitement surrounding this trend, however real, to find sustainable profitability in relation to the company's value. Interesting when investing

Highlights of the event included Apple's Vision Pro and notable advances in native computing, which, while still in their early stages and of little relevance to the company, are exciting. iOS 18 introduced several design improvements, including dark mode, new privacy features and Apple Pay integration between iPhones. These updates are set to significantly improve the user experience.

The iPad announcement also drew attention, with the introduction of AI specifically designed for calculations, studying and various other activities, surpassing expectations of just announcing a calculator app for the iPad.

MacOS (along with Mac Sequoia) introduced important innovations, such as iPhone mirroring and better notifications. However, the standout feature so far is Apple Intelligence, which promises advanced capabilities on devices equipped with the M1 chip and the latest iPhone 15 models. This includes collaboration with OpenAI to integrate GPT-4 chat into Siri, a big leap forward in artificial intelligence features on Apple devices, from writing tools to integrated and personalized personal assistance.

The event emphasized personalization and privacy, addressing growing concerns about these issues, especially in light of the skepticism surrounding other solutions like Microsoft's Copilot+ and its Recall tool. This feature shows how Apple, after falling behind in the AI race, managed to turn things around and reaffirm its motto with a trend-setting rebranding, transforming the technology into Apple Intelligence and its made full use of the ecosystem.

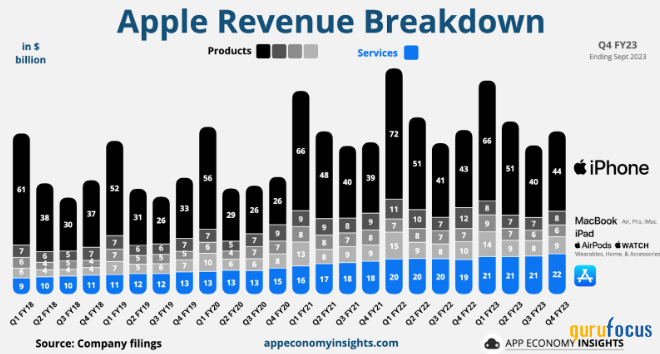

But how does all this fit with the company's finances? Well, just emphasizing that the company is integrating AI into its devices is already good for its credibility with the market, which is valuing it highly. But it is possible to go further. First, Apple has been able to emphasize its ecosystem very well with iPhone mirroring, Apple Pay, quality assurance and more. But most importantly, there is a cyclicality to the company's sales model, where its products change every few years. And in recent quarters, that cycle hasn't helped boost growth. While revenue services have been showing double-digit growth in recent periods (and reducing some of that), the iPhone and its other products have underperformed.

In the quarter ending March 2024, iPhone revenue fell 10 percent quarter-over-quarter, while Mac revenue fell 17 percent. In the graph below, you can see that this has been going on for a while, with iPhone sales reaching $72 billion in the first quarter of 2022 with the launch of the iPhone 13.

Source: App Economy Insights

After a quarter of timid iPhone growth, it seems the cycle has reached a new bullish moment. As already mentioned, many of the features announced, such as Apple Intelligence, will only be available for the new iPhone 15 models and will probably also be available for the iPhone 16 models announced in September. I will be done. So, it is quite possible to predict that a large number of people who have not yet exchanged their old iPhones will do so soon.

To give you an idea, the iPhone 15 Pro Max adoption rate in January was 3.60 percent, compared to 2.30 percent for the iPhone 15 Pro. Basically, the vast majority of the base uses older iPhones, so if they want to access these new features, they will have to upgrade.

Worldwide iPhone 15 adoption rate from September 2023 to January 2024 by model:

Source: Statista

It's difficult to estimate the exact amount, especially given that these features may affect more people in the technology sector who are excited about it, while others tend to adopt new features and become more obsolete. It may take some time to expect. Tool Another important factor is understanding how the next cycles will play out. In 2026, will Apple once again announce key features that will not be present in the iPhone 15 and 16? How relevant can these characteristics be? I guess the biggest leap now will be hardware upgrades to support these technologies and the next updates, even if they are technical, can attract the attention of more specific niches (like filming and other services). (requires a more powerful device).

Another factor driving this cycle is the macroeconomic aspect. Indicators such as inflation, interest rates, disposable income of the population and unemployment have a direct impact on Apple products. This is true not only for sales in the US, but also for other countries where Apple has a lower market share and is seen as a premium (perhaps even luxury) product. Thus, a relief in the macroeconomic cycle also helps its operations.

In the US, Apple has more than 60 percent of the smartphone market, while the opposite is true in the rest of the world, with Android currently accounting for just over 70 percent. This can be seen as an opportunity for growth, with premiumization trends in some countries. This trend should also be accelerated by new features introduced in new products.

Source: Backlinko

Even with all that optimism, if you do some math, you can see that Apple shares are no bargain. The company's revenue in the last 12 months was $381 billion, up from $394 billion in September 2022. Let's imagine that the cycle is really going strong, and that the company will hit $430 billion next fiscal year (which would be phenomenal compared to recent timid. growth). Let's also consider the net margin of 30%, which is an increase of more than 3 percentage points. That would give us a net profit of $129 billion, implying a price-earnings ratio of 25.50.

The price-earnings ratio for the next 12 months is 31, based on market estimates, compared to an average of 24.90 over the past five years and an average of 19.90 over the past decade. More than one in the exercise in the previous paragraph sounds possible to me at some point, but it would still be quite a challenge, and the challenge is just getting close to your average multiple.

A multiple of between 25 and 30 for a company of such quality, which may surprise positively at some point, doesn't seem too expensive to me to be bearish, especially considering that AI's The momentum can last for a significant period of time.

The discounted cash flow model confirms that the shares have very little margin of safety. With optimistic assumptions, such as a growth rate of 12% over the first 10 years and 5% over the last 15 years, and a discount rate of 8%, Apple shares have a fair value of $193, which is a 10% downside. Current price $212.

In my opinion, Apple is still going through the motions, and that was even more evident at WWDC 2024. As Steve Eisman mentioned, the current market cares a lot about stories because the stories seem to be more important than the actual fundamentals. This is intensified when we do the DCF calculation. Even with optimistic assumptions, the result is still not as attractive as it should be. As much as Apple is one of the best companies in the world, you need a certain risk premium and margin of safety when investing.

My outlook for Apple's operations is very positive, believing the company will benefit from the AI cycle and remain one of the world's largest companies. On the other hand, its current price (over $210 per share) doesn't justify high hopes given the limited upside, so while optimistic for the company, I'd only invest in Apple stock at more reasonable levels. Will consider what guarantees me. A large margin of safety.

This article first appeared on GuruFocus.