Artificial intelligence (AI) has taken the tech world by storm over the past 18 months. Brought into the mainstream by the popularity of OpenAI's ChatGPT and other creative AI tools, it has become an indispensable topic in technology and business.

One of the biggest beneficiaries of this newfound AI hype is Nvidia (NASDAQ: NVDA ). Its stock has one of the best runs you'll ever see from a company of its size. That's up nearly 620% over the past two years and over 160% this year, making it the third most valuable company in the world, with a market capitalization of more than $3.2 trillion as of June 17.

Nvidia's impressive rally has been great news for its investors, but with its high valuation outpacing even the most optimistic fundamentals, the stock could be in for a correction. Don't worry, though. There are many companies working with AI that make great investments.

Now here are three to consider:

1. Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing (NYSE: TSM )or TSMC for short, is the world's largest semiconductor foundry and a company that I would argue flies under the radar in terms of its importance in the tech world.

While Nvidia has gotten a lot of attention, it can't be overstated how important TSMC is to its business. People flock to Nvidia for its high-performance GPUs, which are needed to train and power AI applications. However, TSMC manufactures the latest chips that Nvidia uses for its GPUs.

Can Nvidia and others buy chips from another manufacturer? Surely those chips will be as advanced and efficient as TSMC's? Not likely. Its chips are essentially the foundation of the AI ecosystem. Take them away, and every part of the AI pipeline becomes less efficient.

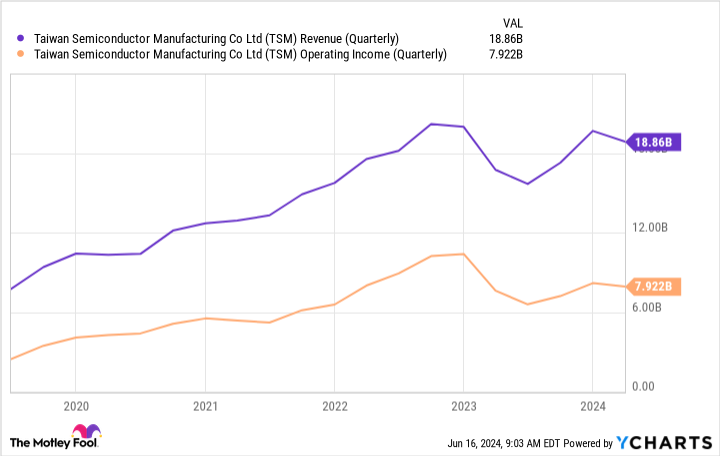

The company's CEO said he expects revenue from some of its AI processors to double this year and make up a low-teens percentage of total revenue. This is great news after seeing its revenue and operating income decline last year due to weak smartphone and PC markets.

2. Amazon

Amazon (NASDAQ: AMZN ) has been using AI for some time to develop logistics for its supply chain, from Alexa to purchasing recommendations.

Its real profit maker is its cloud platform, Amazon Web Services (AWS). Although it only generated around 16% of the company's revenue in the first quarter, it accounted for more than 61% of its operating income. AWS also stands to benefit the most from the advancement of AI.

It is the leading cloud platform, with a 31% market share, with Azure in second place. Microsoft (NASDAQ: MSFT ) At 25%. While Amazon is expanding AWS with AI features, how it uses the platform to enable businesses to develop and scale their own AI applications will be a huge driver of growth in the near future. Can be proven.

Amazon SageMaker, for example, allows businesses to Build, train, and deploy machine learning (ML) models for virtually any purpose. Amazon allows Bedrock businesses. Build and scale creative AI applications that transform their operations and customer experiences.

Providing the infrastructure and tools that companies need to take advantage of AI makes AWS an important part of the technology ecosystem. As Amazon continues to innovate and expand its AI capabilities and infrastructure, it should remain a key player in the tech world.

3. Microsoft

Microsoft, perhaps more than any other tech company, has done a great job of diversifying its business and creating a comprehensive suite of products and services. This is why it has achieved such consistent success over the decades and now sits as the world's most valuable public company.

The tech powerhouse has a hand in many aspects of the business world. Companies rely on it for productivity tools (including Excel, Word, and Teams), enterprise software (Dynamics365), cloud services (Azure), recruiting (LinkedIn), operating systems (Windows), and other critical business applications. are

After signing a partnership with OpenAI that gives Microsoft an exclusive license to OpenAI's large language models (LLMs), the company has an opportunity to strengthen its product suite and strengthen its position in the world of enterprise technology. Maintain the

Microsoft stock looks like a no-brainer for long-term investors, even with its relatively expensive valuation. The stock has been well above its average over the past few years, but AI — and the increased efficiency that should come with it — should provide the company with new areas of growth and a stronger presence with its cloud platform. The increase should continue.

Microsoft is a stock you can feel comfortable buying and holding for the long haul. It has excellent financial health, a history of continuous growth, and its importance to the business world ensures that it will not be easily replaced. It's a trifecta you can't go wrong with today.

Should you invest $1,000 in Amazon right now?

Before buying stock in Amazon, consider this:

gave Motley Fool Stock Advisor The analysis team only indicated what they believed. 10 Best Stocks For investors to buy now… and Amazon was not one of them. 10 stocks that made the cut could generate monster returns in the coming years.

Consider when Nvidia This list was created on April 15, 2005… If you invested $1,000 at the time of our recommendation, You will have $830,777.!*

Stock Advisor Provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks every month. gave Stock Advisor There is a service More than four times S&P 500 Returns since 2002*.

View 10 Stocks »

*Stock Advisor returns till June 10, 2024.

John Mackey, former CEO of Whole Foods Market, is a member of the board of directors of The Motley Fool, an Amazon subsidiary. Stefon Walters holds positions at Microsoft. The Motley Fool has positions in and recommends Amazon, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a Disclosure Policy.

Nvidia's optimization may be inevitable. Here are 3 artificial intelligence (AI) stocks I'd buy instead. Originally published by The Motley Fool.