Artificial intelligence (AI) excitement is apparently driving the stock market higher. Stocks that Wall Street has deemed AI winners, eg Nvidia or Super MicrocomputerThe value has multiplied over the past year, a parabolic journey that has made investors very rich.

Perhaps the next big AI initiative will be companies integrating AI technology to become better businesses. In this category, like stocks UiPath (NYSE: PATH ) And pir.com (NASDAQ: MNDY ) come to mind. Both of these stocks have performed well over the past 18 months, but could go even further.

1. UiPath: Acceleration with AI

UiPath is a great example of artificial intelligence positively impacting a company’s business model. UiPath is a leader in robotic process automation (RPA). This software can observe, learn, and automate repetitive office tasks such as filling out or filing documents, managing interfaces, or sending communications. UiPath has been in business since the early 2000s, so the product has improved as the broader technology has improved, especially over the last decade.

Today, UiPath is implementing AI in all three phases of RPA: discovery, automation, and operations. Management noted a study during its Q4 earnings call that identified demand for AI-powered automation among 70% of surveyed executives. In other words, leveraging AI to make businesses more efficient could become a big topic.

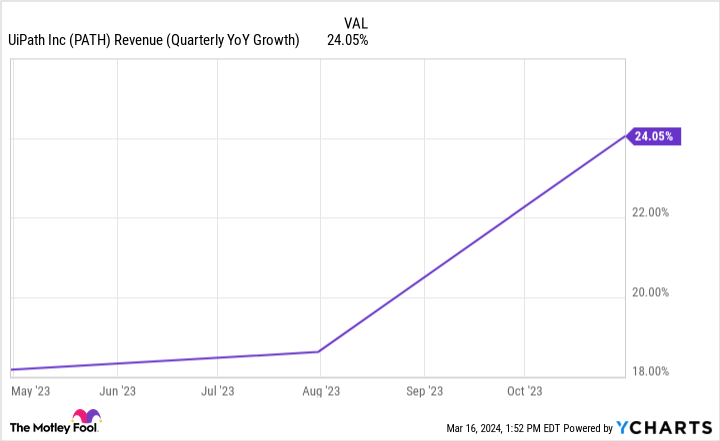

UiPath’s revenue growth has accelerated since early last year, ending with 24% year-over-year growth.

The business is profitable, and analysts expect earnings to grow by an average of 35% annually over the next three to five years. At a forward P/E of just 45 today, UiPath is a bargain if it can meet analyst expectations. The company has beaten analysts’ top and bottom line estimates every quarter as a public company, which bodes well for the future.

Better performance expectations, AI tailwinds, and a cheaper initial valuation? UiPath could be on its way to becoming a monster in the coming years.

2. Monday.com: Changing the work environment

Monday.com is reimagining how employees collaborate, making the addition of generative AI a potential game changer for the company. Monday.com is a cloud-based collaboration software. You can think of it like an operating system for your work. Instead of working through a dozen disjointed apps, employees can work seamlessly on Peer.com through dashboards that can be updated in real-time.

The company is incorporating AI powered by OpenAI and Azure, which creates a ChatGPT-like bot within Peer.com’s platform. Users can ask the bot to quickly generate questions, task ideas, and other content.

The company has become increasingly profitable over time. Free cash flow is about 28% of earnings.

Can the stock go parabolic from here? Today, Monday.com has a $10 billion market cap and trades at just 11 times its earnings. That’s a notable discount for some of the market’s hottest AI stocks, including Palantir Technologies (19 times sales) Crowd strike (19 times sales), and Nvidia (20 times sales). Peer.com is growing revenue like CrowdStrike and faster than Palantir. Admittedly, Nvidia is in a group by itself.

There is an argument that Wall Street is sleeping on Peer.com. The company should continue to prove itself, including exceeding analyst estimates in the coming quarter. If AI can help Monday.com do that, maybe Wall Street will see stocks in a new light.

Monday.com is small enough and growing fast enough that a positive change in sentiment could send shares soaring.

Should you invest $1,000 in UiPath now?

Before buying stock in UiPath, consider this:

gave Motley Fool Stock Advisor The analysis team only indicated what they believed. 10 Best Stocks For investors to buy now… and UiPath was not one of them. 10 stocks that made the cut could generate monster returns in the coming years.

Stock Advisor Provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks every month. gave Stock Advisor The service has more than tripled the return of the S&P 500 since 2002*.

See 10 stocks

*Stock Advisor returns till March 18, 2024.

Justin Pope has positions at Peer.com. The Motley Fool has positions in and recommends CrowdStrike, Monday.com, Nvidia, Palantir Technologies, and UIPath. The Motley Fool has a Disclosure Policy.

2 Artificial Intelligence (AI) Stocks That Could Go Parabolic was originally published by The Motley Fool.