The artificial intelligence (AI) market has exploded since the start of last year, creating many millionaires along the way. The technology's vast potential and potential to boost countless industries have investors excited about nearly every company that has ventured into AI. in fact, Nasdaq-100 The technology sector is up 35 percent since last June, driven primarily by AI excitement.

Despite the meteoric rise of the industry, AI doesn't seem anywhere close to hitting its limit and is likely to create more millionaires in the coming years. Data from Grandview Research shows that the AI market will account for nearly $200 billion in spending in 2023 and projects that it will reach just over $2 trillion by the end of the decade as the sector accounts for 37 percent of the total. The compound is expanding at an annual growth rate.

As a result, it may be worth investing in some of the prominent AI players and potentially profiting from the long-term growth of the market. Here are two millionaire-making artificial intelligence stocks that might be worth buying this June.

1. Nvidia

The boom in AI has benefited few companies as much Nvidia (NASDAQ: NVDA ). The company's stock has gained 223% since last June as it has captured an estimated 90% market share in AI chips.

Years of market dominance of graphics processing units (GPUs) paved the way for Nvidia's foray into AI, while rivals such as Advanced Micro Devices And Intel GPUs spun to catch up are the preferred chips for training AI models, so as the industry has grown, so have Nvidia's earnings.

The chipmaker posted its 2025 first quarter (ending April 2024) earnings on May 22, reporting a 262% increase in revenue and a 690% increase in operating income. This quarter saw Nvidia enjoy another round of AI chip sales growth, reflected by a 427% jump in data center revenue.

Nvidia's rise to the chip market has given it a powerful role in AI that isn't likely to go away anytime soon. Meanwhile, growth catalysts in other tech areas, such as video games, PCs, self-driving cars, and more, could reap benefits for years.

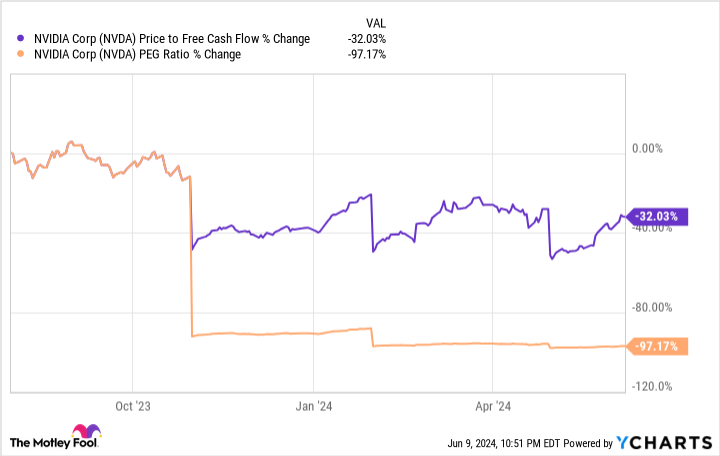

Additionally, despite the rising stock price, Nvidia's stock price actually increased over the past year. The company's price-to-free cash flow ratio and price/earnings-growth ratio dipped by double digits, suggesting that Nvidia's stock may be trading at its best value in months.

As a result, Nvidia is a millionaire-making stock that is too good to pass up and has massive growth potential in the coming years.

2. Microsoft

While Nvidia dominates the hardware side of AI, Microsoft (NASDAQ: MSFT ) AI software has gained an important role. The tech giant was an early investor in the market, sinking $1 billion into ChatGPT developer OpenAI in 2019. The investment has since grown to $13 billion, giving Microsoft exclusive access to some of the industry's most advanced AI models.

Microsoft's partnership with OpenAI has allowed it to develop multiple areas of its business with AI. Over the past year, the company has introduced new creative features to its Office productivity suite, expanded its library of AI tools on its cloud platform Azure, and even announced a venture into chip design. Microsoft has gone full force into AI, and its efforts are beginning to reflect in its earnings.

In the third quarter of 2024 (which ended March 2024), Microsoft's revenue grew 17% year-over-year, with operating income up 23%. The company's intelligent cloud segment received a significant boost from AI, increasing revenue and operating income by 21% and 32%, respectively.

Microsoft's Azure has great potential for AI growth as companies increasingly turn to cloud services to integrate the technology into their businesses. Azure has the second largest share of the cloud market at 25% but is gaining on the industry leader. Amazon Web Services (AWS). In Q4 2023, Azure's cloud market share increased by 2 percentage points, while AWS decreased by 2 points.

Microsoft stock is up 224% since 2019, no doubt creating more than a few millionaires along the way. Meanwhile, the emergence of AI indicates that this is not yet the case. Shares in Microsoft aren't the greatest value, with a forward price-to-earnings ratio of 36. However, the company's dominant role in AI and financial resources makes its stock worth its premium price tag and should be considered before it's too late.

Should you invest $1,000 in Nvidia right now?

Before buying stock in Nvidia, consider this:

gave Motley Fool Stock Advisor The analysis team only indicated what they believed. 10 Best Stocks For investors to buy now… and Nvidia wasn't one of them. 10 stocks that made the cut could generate monster returns in the coming years.

Consider when Nvidia This list was created on April 15, 2005… If you invested $1,000 at the time of our recommendation, You will have $746,217.!*

Stock Advisor Provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks every month. gave Stock Advisor There is a service More than four times S&P 500 Returns since 2002*.

View 10 Stocks »

*Stock Advisor returns till June 10, 2024.

John Mackey, former CEO of Whole Foods Market, is a member of the board of directors of The Motley Fool, an Amazon subsidiary. Danny Cook has no positions in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a Disclosure Policy.

2 Millionaire Maker Artificial Intelligence (AI) Stocks was originally published by The Motley Fool.