gave Nasdaq-100 Technology Sector The index has been in good shape over the past year, posting impressive gains of 50%, as some of the index's key components have seen a red-hot rally thanks to the spread of artificial intelligence (AI).

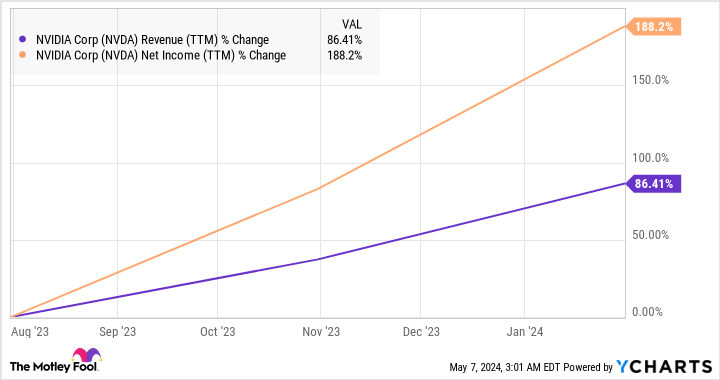

Nasdaq-100 component shares Nvidia (NASDAQ: NVDA )For example, there has been a 221% increase in the last year. The chipmaker's strong rally is justified by its impressive growth. Nvidia's near-monopoly position in the market for AI chips — where it has over 95% market share by some estimates — has supercharged the company's top and bottom lines, as seen in the chart below. It is clear.

Moreover, analysts are expecting Nvidia's revenue to grow at a healthy annual rate of 38% over the next five years. Based on Nvidia's earnings per share of $12.96 in the recently ended fiscal year 2024, its bottom line could jump to around $65 per share five years from now, according to analysts' estimates.

Even if Nvidia trades at 30 times earnings after five years, its stock price could rise to $1,950, according to the Nasdaq-100's earnings multiple. That would be a 112% jump from current levels.

However, Nvidia isn't the only stock making big gains from its rapid adoption of AI. There are two other Nasdaq stocks that are making the most of AI's opportunities and could rise more than Nvidia over the next five years.

1. Super microcomputer

Super Microcomputer (NASDAQ: SMCI ) The stock has outperformed Nvidia with impressive gains of 505% over the past year. Supermicro, known for developing AI server solutions, could continue to outpace Nvidia over the next five years, thanks to the fast-growing market in which it operates.

Supermicro's servers are deployed by data center operators to house chips from the likes of Nvidia and other chipmakers, which keeps their operating costs down. Supermicro's modular server solutions aim to reduce power and cooling costs in data centers.

For example, Supermicro launched liquid-cooled server solutions for deploying Nvidia's massively popular H100 chips in May last year, claiming they can reduce power costs in data centers by up to 40%. . Additionally, Supermicro claims that its liquid-cooled H100 servers can reduce cooling costs by up to 86% compared to existing data centers.

Considering the significant amount of power that AI data centers consume, demand for Supermicro's servers is increasing. This explains why the company's revenue and earnings grew phenomenally last quarter. Super Micro's revenue for the third quarter of fiscal 2024 (for the three months ended March 31) tripled year-over-year to $3.85 billion. Its earnings quadrupled to $6.65 per share.

Supermicro's full-year guidance now calls for revenue to grow 110 percent year-over-year to $14.9 billion at the midpoint. Earnings are expected to increase to $23.69 per share from $11.81 per share in the same period last year. Even better, analysts are expecting its earnings to grow at an annual rate of 62% over the next five years.

This will not be surprising as the market for AI servers is expected to grow by 30% annually over the next decade. Super Micro is growing faster than the market it serves, which is why analysts expect its earnings growth to remain strong. Assuming the company's bottom line grows at a rate of 60% annually over the next five years, its earnings could reach $124 per share after five years.

A 30-point multiple of Nasdaq-100 expected earnings leads to a stock price of $3,720 after five years, a 348% increase from current levels. Even if the growth rate slows, Super Micro still has better growth prospects than Nvidia. So, Supermicro looks like a solid alternative to Nvidia for investors looking to buy AI stocks now, given that it looks set to outperform the latter over the next five years.

2. Meta-Platforms

Meta platforms (NASDAQ: META ) Another tech giant is taking advantage of AI adoption. The social media bellwether is integrating AI tools into its various platforms and is also leveraging the technology to help advertisers increase their return on spend.

CEO Mark Zuckerberg detailed Meta's AI initiatives on the company's first-quarter earnings conference call last month. He claimed that the company's generative AI assistant, MetaAI, has been tested by “tens of millions of people” and will be rolled out in more countries and languages in the future.

Meta AI is being integrated into WhatsApp, Facebook, Messenger and Instagram. From allowing creators to create high-quality images to businesses recommending products to consumers, MetaPlatforms is positioning itself to monetize its AI offerings in the long term. According to Zuckerberg:

Conversely, once our new AI services reach scale, we have a strong track record of effectively monetizing them. There are several ways to scale business, including scaling business messaging, introducing advertising or paid content into AI interactions, and enabling people to pay to use larger AI models and access more compute. to gain. And on top of that, AI is already helping us improve app engagement which naturally leads to more ad views and directly optimizing ads to deliver more value.

The good news for investors is that Meta's AI offerings are giving the company a good boost. Its revenue rose 27 percent year-over-year to $36.4 billion in the first quarter of 2024. Earnings, meanwhile, rose an impressive 114% year-over-year to $4.71 per share. Meta should be able to maintain healthy earnings growth rates over the long term as it begins to monetize more of its AI offerings.

Analysts are currently expecting the company's revenue to grow at an annual rate of 28% over the next five years, which would be a nice jump from its 11% annual revenue growth over the past five years. Using its 2023 earnings of $14.87 per share as a baseline, Meta's bottom line could jump to $51 per share in five years based on potential earnings growth that analysts expect.

A 229% jump from current levels, with a 30-point multiple to Nasdaq-100 earnings five years later toward a stock price of $1,530. Given that the stock currently trades at 27 times earnings, investors are getting a good deal on this Nasdaq stock that looks set to outperform Nvidia in the long run.

Should you invest $1,000 in Nvidia right now?

Before buying stock in Nvidia, consider this:

gave Motley Fool Stock Advisor The analysis team only indicated what they believed. 10 Best Stocks For investors to buy now… and Nvidia wasn't one of them. 10 stocks that made the cut could generate monster returns in the coming years.

Consider when Nvidia This list was created on April 15, 2005… If you invested $1,000 at the time of our recommendation, You will have $550,688.!*

Stock Advisor Provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks every month. gave Stock Advisor There is a service More than four times S&P 500 Returns since 2002*.

View 10 Stocks »

*Stock Advisor returns on May 6, 2024

Randy Zuckerberg, former director of market development and spokeswoman for Facebook and sister of MetaPlatforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions and recommends MetaPlatforms and Nvidia. The Motley Fool has a Disclosure Policy.

2 Nasdaq stocks that could crush Nvidia and deliver big gains, thanks to artificial intelligence (AI) was originally published by The Motley Fool.