Artificial intelligence (AI) is dominating the news cycle as the technological arms race kicks into high gear. Microsoft (NASDAQ: MSFT ) Early led the pack with its investment in AI pioneer OpenAI, but the alphabet (NASDAQ: GOOGL ) (NASDAQ: GOOG), Meta (NASDAQ: META )and the rest of big tech have made their own forays into AI, with varying degrees of success.

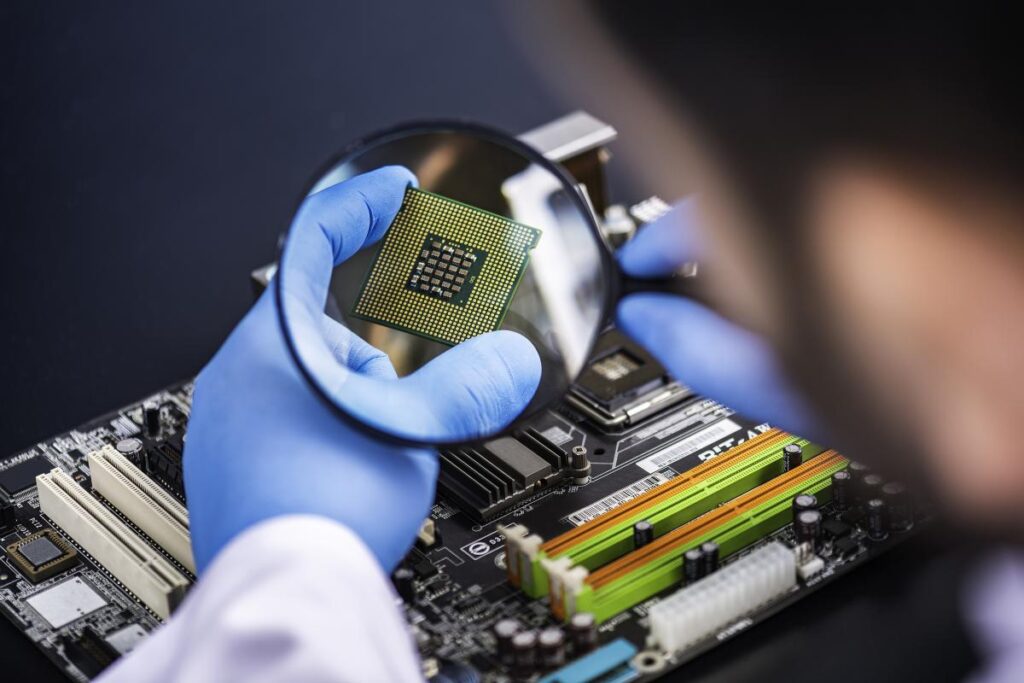

However, no company has had as much success running AI. Nvidia (NASDAQ: NVDA ). Semiconductor designs and sells the giant graphics processing units (GPUs) that allow most power-hungry AI applications to operate. They have become the industry standard due to their speed and efficiency. The chipmaker is now the world's third-largest company by market capitalization after its stock has risen nearly 200 percent in the past year.

Investors are excited by Nvidia's recent announcement of its next-generation AI chips, the Grace Blackwell “Superchips.” The first iteration, the GB200, will allow for a 25-fold reduction in power consumption and a 30-fold increase in speed in some AI applications compared to its predecessor.

Room for more?

While Nvidia dominates AI semiconductors and is likely to continue to do so, it is not the only player. Analysts say the market will be massive. According to Grandview Research estimates, the AI market will exceed $1.8 trillion by 2030, with a compound annual growth rate (CAGR) of 37.3%. The AI field will only benefit from competition, and many companies stand to see significant growth. Here are two that deserve a place on investors' watchlists.

AMD

Shares of Advanced Micro Devices (NASDAQ: AMD ) Nvidia's gains have been overtaken, but in this market, all things are relative. Returns have still been impressive: The stock is up more than 72 percent in the past year.

HSBC analyst Frank Lee believes AMD will capture 10% of the AI GPU market in 2025, representing $12.3 billion in company sales. This will be a massive development. In 2023, the company reported $6.5 billion in revenue for its data center segment, which houses its AI chips.

A major concern is AMD's ability to compete with the GB200. Some have pointed out that the company's premier AI GPU, the MI300, isn't all that impressive. However, AMD intends it to be a competitor to the current iteration of Nvidia's chips and will likely announce an updated, more powerful chip to compete directly with the GB200. However, at this time, this is only speculation. AMD may fail to offer something equivalent to the GB200 or Nvidia may come out with its next iteration before it does.

But it's definitely worth seeing what AMD comes up with.

Intel

Until the advent of AI, Intel (NASDAQ: INTC ) was the king of semiconductors. However, the company's specialty has been central processing units (CPUs) rather than GPUs. CPUs are more versatile than GPUs, excelling at specific tasks, and are still standard in many devices such as laptops.

As a result, Intel has missed most of the AI waves. Its stock is up a more modest 17 percent over the past year. However, Intel isn't planning to sit idle. The company recently announced the latest iteration of its AI-specific chip, the Gaudi 3. Intel claims the chip will deliver “50% faster time-to-train” for some AI applications and 40% higher power efficiency than Nvidia's H100. This is a big win for Intel, but it remains to be seen how the Gaudi 3 stacks up against the HB200.

Intel is also pushing what it calls “AI everywhere.” It is releasing the company's fifth-generation Xeon CPUs, which will include “AI acceleration” in each chip. CPUs can still power some AI applications, and will be the most powerful on the market. AI investors may want to keep an eye on Intel.

Investor takeaway.

While it's likely that Nvidia will continue to dominate the market, both AMD and Intel stand to see significant growth if they can capture just a fraction of it. Given both companies' long history of success and the sheer size of the market, it's more than likely, making them worth watching.

Should you invest $1,000 in Advanced Micro Devices now?

Before buying stock in Advanced Micro Devices, consider this:

gave Motley Fool Stock Advisor The analysis team only indicated what they believed. 10 Best Stocks For investors to buy now… and Advanced Micro Devices was not one of them. 10 stocks that made the cut could generate monster returns in the coming years.

Consider when Nvidia This list was created on April 15, 2005… If you invested $1,000 at the time of our recommendation, You will have $488,186.!*

Stock Advisor Provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks every month. gave Stock Advisor There is a service More than four times S&P 500 Returns since 2002*.

View 10 Stocks »

*Stock Advisor returns on April 22, 2024

Johnny Rice has no position in any stocks. Randy Zuckerberg, former director of market development and spokeswoman for Facebook and sister of MetaPlatforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Suzanne Frey, an Alphabet executive, is a member of The Motley Fool's board of directors. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, MetaPlatforms, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short May 2024 $47 calls on Intel. The Motley Fool has a Disclosure Policy.

2 artificial intelligence (AI) chipsets to look at that aren't Nvidia was originally published by The Motley Fool.