Nvidia (NASDAQ: NVDA ) A great deal has been done in the last two decades. The chipmaker cemented its position as the gold standard in graphics processors for video games and other multimedia. Additionally, its high-speed computing platform has become a leading solution for demanding data center workloads such as analytics, artificial intelligence, and scientific simulation.

During that period, Nvidia saw its share price rise 45,900 percent during its transition from computer graphics trailblazer to data center powerhouse. To put this figure into context, a $10,000 investment in Nvidia in April 2004 would now be about $4.6 million.

The stock has been especially hot lately, with shares tripling in the past year alone. Despite this, Wall Street is still very bullish on Nvidia. The stock has a consensus rating of “Buy” and an average one-year target of $1,000 per share, 22% above its current price. Even more compelling, of the 60 analysts who follow Nvidia, none recommend selling right now.

Here's what investors should know.

Nvidia dominates the market for high-speed computing solutions.

Nvidia is best known for inventing the graphics processing unit (GPU), a chip that is now synonymous with ultra-realistic 3D graphics and accelerated computing, a discipline that uses artificial intelligence (AI) and data to accelerate data center workloads. Uses specialized hardware for To measure its success, Nvidia has more than 95% market share in workstation GPUs, 94% market share in data center GPUs, and more than 80% market share in AI processors, according to Analytics analysts.

However, Nvidia is more than a GPU company. Its data center hardware portfolio also includes Grace Central Processing Unit (CPU) and high-performance networking platforms purpose-built for AI. Additionally, Nvidia has expanded its ability to monetize 3D graphics and AI by incorporating it into subscription software and cloud services.

Nvidia AI Enterprise is a collection of development tools, software frameworks, and pre-trained models that help enterprises build a variety of AI applications, including computer vision, conversational intelligence, and recommender systems. . Additionally, DGX Cloud combines Nvidia AI enterprise software with supercomputing infrastructure to offer a comprehensive AI-as-a-service.

Similarly, Nvidia Omniverse Cloud consists of hardware, software and services for 3D application development. It also serves as a simulation engine capable of training and evaluating machine learning models for autonomous robots and self-driving cars. Additionally, Omniverse includes tools for creating interactive avatars that address use cases such as unplayable video game characters and digital customer service agents.

In short, Nvidia's robust accelerated computing platform includes hardware, software and services that position the company as a one-stop shop for 3D graphics and artificial intelligence. CFRA analyst Angelo Zeno says the full-stack strategy gives Nvidia an “incredible competitive moat.”

Nvidia followed up a strong fourth quarter with a wave of product announcements.

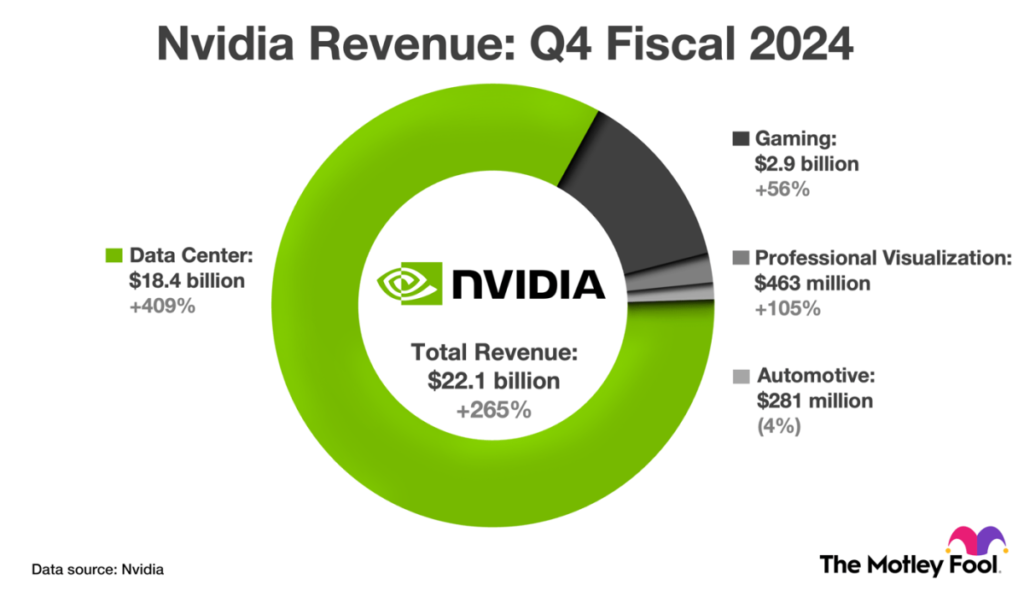

Nvidia reported impressive fourth-quarter financial results, crushing estimates on both the top and bottom lines. Revenue increased 265% to $22.1 billion, gross profit margin increased 10 percentage points, and non-GAAP net income increased 486% to $5.16 per share.

The driver behind this stellar performance was strength in the data center category, which CEO Jensen Huang attributed to two tailwinds. First, data centers are moving from general-purpose to high-speed computing. Second, data centers are investing aggressively in the computing infrastructure needed to support generative AI.

The chart below provides more detail on Nvidia's fourth quarter revenue across its four primary product categories.

Nvidia announced several notable products at its annual GPU Technology Conference (GTC) in March. The headline announcement was its latest GPU architecture, Blackwell. “Generative AI is the defining technology of our time. Blackwell is the engine powering this new industrial revolution,” said CEO Jensen Huang.

Additionally, Nvidia announced a new superchip that combines Blackwell GPUs and Grace CPUs, new high-performance networking platforms, and its next-generation supercomputer for autonomous vehicles. The company also announced Project Groot, which consists of a supercomputer built for machine learning models and humanoid robots.

Wall Street expects strong earnings growth, but Nvidia stock isn't cheap.

Going forward, the graphics processor market is predicted to grow 28 percent annually through 2030, and AI spending on hardware, software, and services is expected to grow 37 percent annually over the same period. This led Nvidia to increase annual sales by more than 30% by the end of the decade, implying similar revenue growth.

In fact, Wall Street analysts expect the company to grow earnings per share by 35% annually over the next five years. In this context, its current valuation of 69 times earnings sits somewhere between reasonable and expensive. In other words, patient investors can buy a very small position in this stock right now, but it might be more prudent to wait for a slightly cheaper price.

Should you invest $1,000 in Nvidia right now?

Before buying stock in Nvidia, consider this:

gave Motley Fool Stock Advisor The analysis team only indicated what they believed. 10 Best Stocks For investors to buy now… and Nvidia wasn't one of them. 10 stocks that made the cut could generate monster returns in the coming years.

Consider when Nvidia This list was created on April 15, 2005… If you invested $1,000 at the time of our recommendation, You will have $488,186.!*

Stock Advisor Provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks every month. gave Stock Advisor There is a service More than four times S&P 500 Returns since 2002*.

View 10 Stocks »

*Stock Advisor returns on April 22, 2024

Trevor Genuine has positions in Nvidia. The Motley Fool has positions and recommends Nvidia. The Motley Fool has a Disclosure Policy.

1 Monster Artificial Intelligence (AI) Growth Grows 45,900% in 20 Years Buy Now, According to Wall Street Originally published by The Motley Fool.