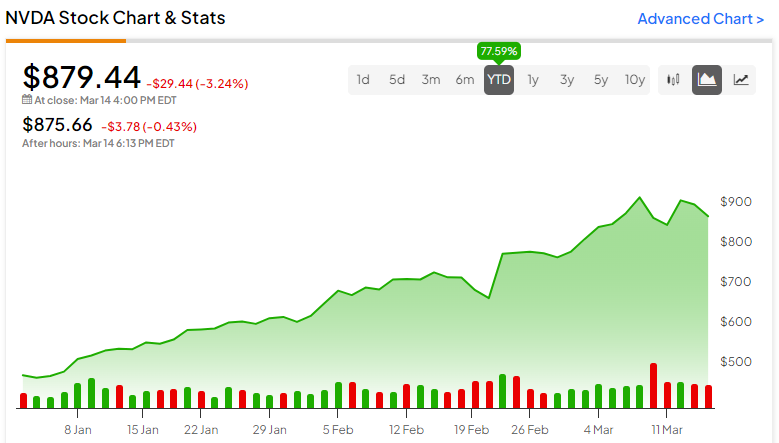

Chipmaker and AI prodigy Nvidia (NASDAQ:NVDA) continues its unstoppable upward march, with its price more than tripling in 2023 and nearly 78% year-to-date. The recent Q4 beat was spectacular and pushed NVDA to its all-time highs. Being at the forefront of the AI revolution, I maintain a strong stance on NVDA. I believe in its long-term growth potential, driven by the artificial intelligence (AI) boom and its relatively favorable valuation. Therefore, I would buy the stock at current levels.

NVDA Posts Blowout Q4 Earnings Again

Now the world’s third-largest company, Nvidia posted another blowout Q4 result on February 21, driven by high-speed computing and generative AI momentum. Adjusted earnings of $5.16 per share easily beat analysts’ estimates of $4.59 per share. Also, this figure came in significantly higher (+486%) than the fiscal Q4-2023 (ending January 2023) figure of $0.88 per share.

Impressively, Q4 revenue rose 265% year-over-year to $22.1 billion, beating consensus estimates of $20.5 billion. On top of that, its adjusted gross margin rose 10.6 percentage points to 76.7 percent from 66.1 percent a year ago.

Importantly, NVDA’s crown jewel segment, data center revenue, tripled year-over-year to $47.5 billion in fiscal 2024. The segment also saw a notable increase in Q4 revenue, up 409 percent year-over-year to $18.4 billion.

As expected, US export control restrictions led to a decline in revenues in China. During the earnings call, management confirmed that China represented only a mid-single digit share of data center revenue in Q4, compared to an average of 20-25% over the past few quarters.

Looking ahead, Q1 guidance looks promising, with revenue expected to be around $24 billion. Adjusted gross margin is forecast to be approximately 77%.

Expressing great optimism for the future, CEO Jensen Huang commented during the call, “We are at the beginning of two industry transformations and both are at the industry level. The first is the transition from normal to high-speed computing… [and] Another industrial transition is called generative AI.”

NVDA’s long-term momentum remains impressive.

NVDA is a Wall Street favorite for a good reason. Over the past six years, Nvidia’s revenue has grown nearly 9x, from $6.91 billion in FY2017 to $60.9 billion in FY2024 (see below). Even more admirably, its earnings have grown 18-fold from $1.67 billion to $29.8 billion over the same period, thanks to its growing profit margins. This data instills in me a deep sense of confidence in NVDA’s strong business fundamentals and its expected growth trajectory, driven by AI.

According to Wall Street estimates, NVDA is expected to post a net profit of $64.3 billion in fiscal 2025, more than double the $32.3 billion reported in the recently ended fiscal 2024. These remarkable growth prospects provide compelling reasons to continue investing in this AI giant, especially considering that the story of disruptive AI growth is only just beginning.

NVDA could potentially go for a stock split.

Approaching the $1,000 milestone price mark, many Wall Street analysts believe the stock could be split in the next year or so. NVDA had a 4:1 stock split in May 2021, when it was valued at around $600. This move provided easy access for small retail investors to purchase stocks. While a stock split does not inherently change a company’s valuation or fundamentals, it broadens its investor base by attracting smaller investors.

Other notable companies that have opted for a stock split include EV maker Tesla (Nasdaq: TSLA) (in 2020 and 2022) and Apple (Nasdaq: AAPL), Amazon (NASDAQ:AMZN), and the alphabet (NASDAQ:GOOGL). Therefore, it is likely that NVDA may consider another stock split in the near future.

Given its earnings potential, the NVDA valuation is still not expensive.

On the verge of overtaking Amazon by market capitalization and eclipsing Apple’s market cap, many investors have been hesitant to buy NVDA stock amid concerns about its spectacular rally and overvaluation.

However, in contrast, NVDA stock is not expensive at all. Currently, it is trading at an attractive forward P/E ratio of 36.9x (based on FY2025 earnings expectations). It is relatively cheaper than multiples of its peer group. For example, US-based semiconductor company Advanced Micro Devices (NASDAQ: AMD) is trading at a forward P/E of 53.4x.

Additionally, its current valuation reflects a discount to its five-year average of 46x. These are attractive discount levels and potentially represent a great buying opportunity for AI market titan NVDA given its phenomenal growth potential.

Is NVDA Stock a Buy, According to Analysts?

NVDA stands out as an unstoppable force, a stock that commands widespread attention. With 39 Buys and two Hold ratings from analysts over the past three months, the consensus rating is undoubtedly a Strong Buy. After all, Nvidia stock’s average price of $909.49 suggests shares will return 3.4% over the next year.

Interestingly, the average target price has been rising incredibly as analysts try to match NVDA’s consistent record-breaking highs month after month. That’s up from $661 just three months ago to $909.

Conclusion: Consider buying NVDA for its long-term AI potential.

NVDA stock is poised to reach unprecedented heights, propelled by expectations for phenomenal growth within the AI space. As the frontrunner in the industry, NVDA maintains a considerable lead over its competitors, boasting a near-monopoly position in AI chips with nearly 80% market share. This dominant position ensures a strong moat and strengthens its grip on the burgeoning AI landscape.

The insatiable demand for all things AI far exceeds the available supply, indicating the potential for adoption of high-speed computing and creative AI across industries and regions. This trend is expected to be the primary driver of revenue and earnings growth for NVDA in the coming years.

With NVDA’s highly anticipated live GTC conference scheduled for March 18-21, my bullish view on the company remains firm, prompting me to buy shares at their current levels.

Disclosure