Whether you’re a casual investor or trade professionally, you’ll be increasingly aware of the artificial intelligence (AI) that took off last year. OpenAI’s launch of ChatGPT has reignited interest in the technology, prompting countless tech companies to shift their businesses to the high-growth sector.

As a result, the AI market is expected to expand at a compound annual growth rate of 37 percent by 2030, reaching just over $2 trillion. The industry is expanding at a rapid pace, making it one of the best places for long-term investment.

Two stocks are currently advancing in AI. Advanced Micro Devices (NASDAQ: AMD ) And Nvidia (NASDAQ: NVDA )Their shares recently gained 149% and 257% year-on-year respectively. As prominent chipmakers, these companies provide the hardware necessary to train and run AI models. Their stocks may rise further in the coming years as the market develops.

So, let’s compare the trading of these companies and determine if AMD or Nvidia is the better AI stock this March.

Advanced Micro Devices

AMD was slightly overshadowed by Nvidia’s headstart in AI chips last year, as Nvidia captured an estimated 80% to 95% market share in AI graphics processing units (GPUs).

However, industry-wide potential suggests that AMD won’t need to dethrone Nvidia to see big gains from AI. So, despite spending years prioritizing its position in central processing units (CPUs), AMD has focused on developing its GPU technology and expanding into the emerging AI market.

Last December, the company unveiled its MI300X AI GPU. The chip was designed to compete directly with Nvidia’s offerings and has already attracted the attention of some of the tech’s leading players.

In November 2023, Microsoft announced that Azure would become the first cloud platform to use AMD’s MI300X to improve AI capabilities. Microsoft has a close partnership with ChatGPT developer OpenAI, making the company a powerful ally for AMD. A deal with Meta — which also aims to use the new chips — also helps make AMD’s future in AI look bright.

Moreover, AMD isn’t just banking on stealing market share from Nvidia in GPUs. AMD seeks to lead its space within AI by investing in AI-enabled PCs. According to research firm IDC, PC shipments are expected to see a big boost this year, with AI integration acting as a key catalyst. And a Canalys report predicts that 60% of all PCs shipped in 2027 will be AI-enabled.

Nvidia

Nvidia captivated Wall Street last year as its chips became the gold standard for AI developers everywhere.

Growing demand for AI GPUs has skyrocketed Nvidia’s revenue. In the fourth quarter of 2024 (ended in January), the company’s revenue grew 265 percent year-over-year to $22 billion. Meanwhile, operating income rose 983 percent to nearly $14 billion. The monster growth was primarily driven by a 409% increase in data center revenue, reflecting increased chip sales.

In addition to growing earnings, Nvidia’s free cash flow has grown 430% in the past year to more than $27 billion, significantly more than AMD’s $1 billion.

So, despite new GPU releases from its rivals, Nvidia’s headstart in AI likely left it with more cash reserves to continue investing in its technology and maintain market dominance. .

Nvidia has a powerful position in AI that isn’t likely to fade anytime soon. Its market cap crossed $2 trillion this year thanks to its tremendous success in AI. AMD’s market cap is significantly lower at around $327 billion. However, this could mean that AMD has more room to run in the long run as the company is still in the early stages of its AI journey.

Is AMD or Nvidia the better AI stock?

AI could potentially boost countless industries, from cloud computing to consumer products, autonomous vehicles, video games and more. With generative technology becoming a priority in many sectors, chip demand is only likely to grow in the near future.

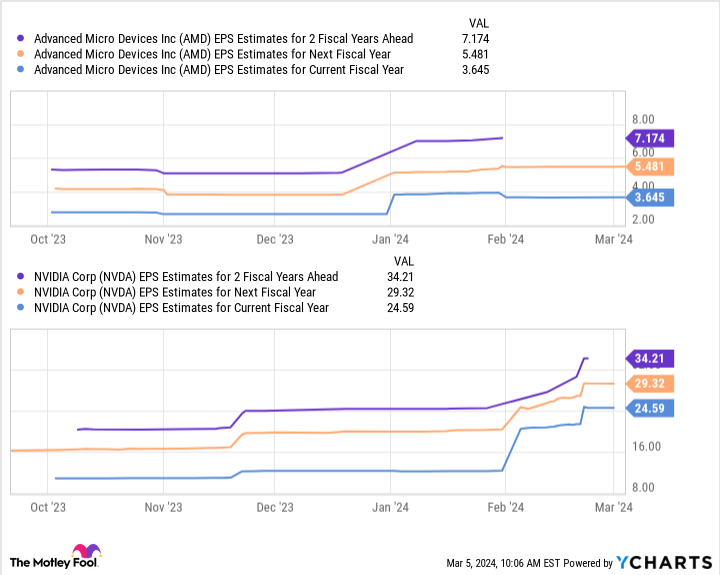

As a result, AMD and Nvidia are two interesting options for investing in AI. However, earnings per share (EPS) estimates suggest that AMD may have more growth potential in the near term.

The chart shows that AMD’s earnings could reach only $7 per share over the next two fiscal years, while Nvidia’s could reach $34 per share. On the surface, Nvidia looks like the clear winner. However, multiplying these figures by the companies’ forward price-to-earnings ratios (AMD’s 56 and Nvidia’s 35) yields stock values of $403 for AMD and $1,197 for Nvidia.

Considering their current positions, these projections would increase AMD’s stock by 99% and Nvidia’s by 41% by fiscal 2026.

With a heavy investment in AI and potentially more room to run, AMD is a better AI stock than Nvidia and makes a screaming buy this month.

Where to invest $1,000 now.

When our analyst team has a stock tip, it can pay to be heard. After all, they’ve been running the newsletter for two decades. Motley Fool Stock Advisorthe market has more than tripled.*

They have just revealed what they believe. 10 Best Stocks Investors to Buy Now… And Advanced Micro Devices Made the List — But There Are 9 Other Stocks You’re Overlooking

See 10 stocks

*Stock Advisor returns till March 8, 2024.

Danny Cook has no position in any stocks. The Motley Fool has positions and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a Disclosure Policy.

The Better AI Stock: AMD vs. Nvidia was originally published by The Motley Fool.