Shares of Qualcomm (NASDAQ: QCOM ) And Intel (NASDAQ: INTC ) going in opposite directions this year, which may seem a little surprising at first since both chipmakers are facing serious difficulties in their core markets and are relying on the spread of artificial intelligence (AI) to turn their fortunes around. are doing

While Intel’s business has been hurt by declining sales of personal computers (PCs) in recent years, Qualcomm is struggling due to booming smartphone sales. Both of these end markets are expected to benefit greatly from the adoption of AI. However, Qualcomm’s 19% rise in the stock market in 2024 and Intel’s 23% slide indicate that the former may be doing better as far as benefiting from the AI catalyst is concerned.

Let’s see if that’s really the case, and if Qualcomm is the better AI pick of the two.

The case of Qualcomm

The smartphone market is poised for a shakeup this year, and analysts are expecting the same to happen at Qualcomm. The chipmaker’s revenue in fiscal 2023 (which ends Sept. 24, 2023) fell 19 percent to $35.8 billion from a year earlier, while adjusted earnings fell 33 percent to $8.43 per share. This was not surprising, as smartphone shipments are expected to decline by 3.2% in 2023, according to IDC, after a huge 11.3% decline in 2022.

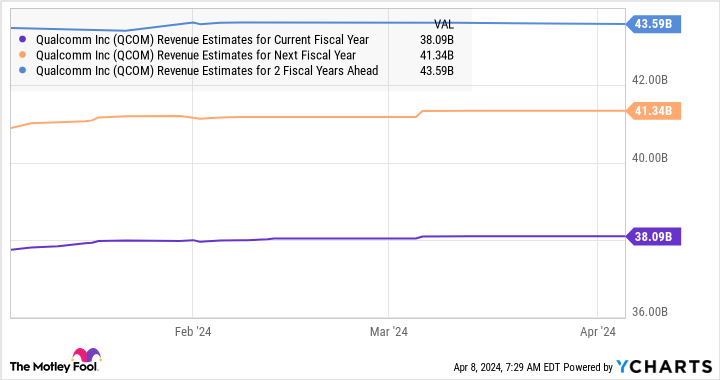

This year, however, analysts expect Qualcomm’s earnings to rise, followed by further gains in the next two fiscal years. This is evident from the following chart:

The development of AI-powered smartphones is going to play a key role in Qualcomm’s transformation. Market research firm IDC is forecasting that 170 million AI-enabled smartphones could be shipped this year, more than triple last year’s shipment of 51 million units. More importantly, IDC suggests that AI smartphones will account for 15% of the overall smartphone market this year, indicating that they have a lot of room for growth in the future.

Even better, the AI smartphone market is expected to grow at a CAGR of 83 percent from 2024 to 2027. Qualcomm is in a good position to take advantage of this space, as it supplies processors to smartphone OEMs (original equipment manufacturers). apple And Samsung. Qualcomm’s Snapdragon processors are powering the AI features on Samsung’s latest Galaxy S24 flagship smartphones, and it’s looking to push the envelope even further with a new chip aimed at mid-range smartphones. Is.

It’s worth noting that market research firm Counterpoint Research expects Qualcomm to capture more than 80 percent of the AI smartphone market in the next two years. That wouldn’t be surprising considering the pace Qualcomm has already set in this market by taking down flagship users like Samsung.

Moreover, Qualcomm has also set its sights on the AI PC market, which could open up a new opportunity for the company to expand its business in the future. As such, Qualcomm is well-placed to take advantage of some of the rapidly growing AI-related opportunities, which explains why the chip stock is moving higher this year.

The case of Intel

Things have gone from bad to worse for Intel as the year has progressed. The company started 2024 with a better-than-expected earnings report for the fourth quarter of 2023, but failed to deliver a strong outlook. Intel’s guidance for the first quarter of 2024 fell well short of expectations, which is why investors hit the panic button. Another blow to Intel came after it was revealed that its foundry unit was suffering heavy losses.

As for the company’s AI efforts, management pointed out on a January earnings conference call that its revenue pipeline from AI accelerators now exceeds $2 billion. The company claims that it has “advanced its supply chain to meet growing consumer demand and we expect a meaningful acceleration in revenues throughout the year.”

However, as consensus estimates expect Intel to deliver $57.4 billion in total revenue this year, the $2 billion revenue pipeline indicates that AI may not move the needle significantly for the company. will Chipzilla, on the other hand, faces stiff competition. AMD In the market for AI PC processors. AMD CEO Lisa Su claims that the company’s Ryzen processors are powering more than 90% of AI PCs currently on the market.

This probably explains why AMD’s revenue from client business grew at a faster pace than Intel’s last quarter. More specifically, Intel’s Client Computing Group revenue of $8.8 billion was up 33% year-over-year in Q4 2023. AMD, on the other hand, recorded a 62% year-over-year increase in its client segment revenue over the same period.

With AMD stealing market share from Intel in the PC market thanks to AI-powered PCs, and Qualcomm looking to cut its teeth in that market as well, Chipzilla is set to make the most of AI’s growing adoption. Can be difficult.

Decision

It is clear that Qualcomm is better placed to take advantage of AI opportunities because of the solid stake it is expected to command in AI smartphones. Meanwhile, Intel has a lot to do in the market for both AI data center chips and PCs. Moreover, Intel is expensive compared to Qualcomm, with a price-to-earnings (P/E) ratio of 110. Qualcomm is very cheap with a P/E ratio of 24.

Also, Qualcomm’s forward P/E of 18 is lower than Intel’s 33. Investors are getting a better deal on Qualcomm right now, which is why they might want to consider buying this AI stock over Intel before it goes higher after its solid start. until 2024.

Should you invest $1,000 in Qualcomm right now?

Before buying stock in Qualcomm, consider this:

gave Motley Fool Stock Advisor The analysis team only indicated what they believed. 10 Best Stocks For investors to buy now… and Qualcomm wasn’t one of them. 10 stocks that made the cut could generate monster returns in the coming years.

Consider when Nvidia This list was created on April 15, 2005… If you invested $1,000 at the time of our recommendation, You will have $539,230.!*

Stock Advisor Provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. gave Stock Advisor There is a service More than four times S&P 500 Returns since 2002*.

View 10 Stocks »

*Stock Advisor returns on April 8, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple and Qualcomm. The Motley Fool recommends Intel and recommends the following options: long January 2023 Intel $57.50 calls, long January 2025 Intel $45 calls, and short May 2024 Intel $47 calls. The Motley Fool has a Disclosure Policy.

Better Artificial Intelligence (AI) Stocks: Qualcomm vs. Intel was originally published by The Motley Fool.