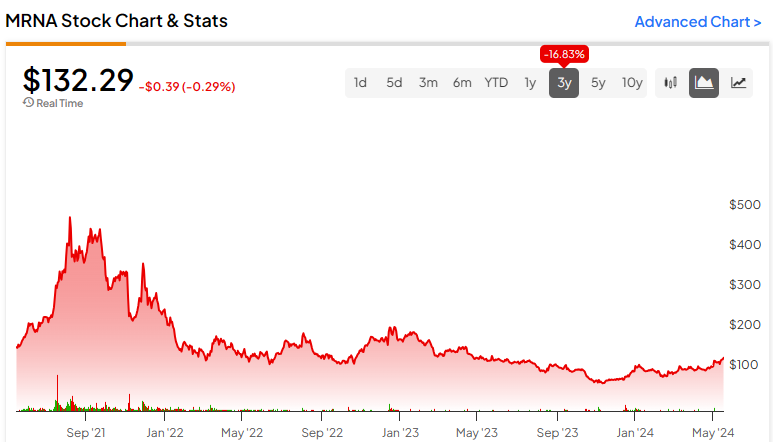

Moderna (Nasdaq: mRNA) stock has fallen from its all-time high. However, the company is once again on the move – in a good way. With contributions around artificial intelligence (AI) and positive cancer trial data gaining investor interest, the stock has risen 68% over the past six months. Personally, though, I'm still not convinced this development buys MRNA stock and need more data before making a decision. For now, I remain neutral.

Moderna and OpenAI Partnership

In April, Moderna and OpenAI said they were deepening their partnership by announcing expanded access to ChatGPT Enterprise for Moderna's workforce. The collaboration empowers Moderna staff to develop custom GPTs (Generative Pre-Training Transformers) designed for specific purposes, ranging from data analysis to image generation.

After a successful trial period, which saw the creation of 750 custom GPTs and widespread adoption among employees, Moderna is now ready to introduce ChatGPT Enterprise to thousands of its staff members. According to OpenAI, one of the most important GPTs used by Moderna's staff is Dose AI. GPT can help clinical trial teams understand the best dose to use by reviewing and analyzing clinical data.

“Dose ID GPT has the potential to expand the amount of work we can do as a team. We can comprehensively review these extremely large amounts of data, helping to ensure security and privacy. can do so in a highly effective, safe and accurate manner,” said Mecklet Workna, director of clinical development at Moderna, in a statement.

ChatGPT offers enormous potential and can help with a variety of tasks, from improving cooking skills to drug discovery. Its range of applications is huge. However, ChatGPT does not fully explain its calculations and does not provide sources, potentially creating problems that will need to be overcome. It is also true that the benefits may take some time to show.

Moderna's Cancer Hopes.

For some time now, I've considered Moderna a non-investment. The pandemic provided this mRNA-driven pharma company with a unique opportunity to generate revenue. However, the COVID-19 vaccine, Spikevax, was its only marketable product, and remains so. Thus, investors should be rightly concerned about future earnings. The company reported Spikevax sales of $2.8 billion in the fourth quarter of 2023 – significant, but massively less than the pandemic.

Cancer vaccines are part of the company's broad pipeline, and mRNA-4157 is likely one of the most interesting parts of the portfolio. In a phase II trial, patients received either the immunotherapy treatment pembrolizumab — a recognized standard of care after surgery — or pembrolizumab combined with mRNA-4157.

The study provided two positive headline data points. First, it confirmed the favorable safety profile of combination therapy. Moderna reported that there was no significant increase in toxicities or adverse effects of combination therapy compared with pembrolizumab monotherapy.

Second, recurrence-free survival data showed that combination therapy was more effective than pembrolizumab monotherapy. Moderna noted that 78.6% of patients had no cancer recurrence 18 months after treatment compared with 62.2% of patients in the control group who received monotherapy.

mRNA-4157 is designed to treat patients with solid tumors of the head and neck. The preliminary data announcement sent stocks to a three-month high in April.

Moderna's Patent Dispute

While investors were excited by the trial announcements, some analysts have highlighted a potential sticking point. Moderna uses intellectual property developed by Genevant Sciences and Arbutus Biopharma.NASDAQ:ABUS). Companies hold patents for lipid nanoparticles (LNP). These are vehicles for gene delivery that accommodate both nucleic acids and proteins. In other words, they allow mRNA vaccines to evade the body's immune system.

The technology allowed Spikevax to succeed and is central to other projects in the pipeline, but Genevant Sciences and Arbutus Biopharma claim that Moderna used LNP without properly compensating the two companies or obtaining a license. These allegations have been validated by the United States Patent and Trademark Office.

Additionally, Genevant licenses the technology to other companies, proving that the patents are enforceable. A judgment against Moderna could result in billions of dollars in damages, worsening the company's negative cash flow position.

Is Moderna Stock a Buy According to Analysts?

Twilio stock comes in as a moderate buy based on 18 analyst ratings over the past three months. Currently there are eight buy, seven hold, and three sell ratings. The average MRNA stock price target is $130.29, with a high estimate of $214 and a low estimate of $75. The average price target indicates a downside potential of 1.3%.

The Bottom Line on Moderna Stocks

Moderna is developing a very exciting and potentially commercially attractive pipeline of drugs and therapies using mRNA technology. His vaccine against solid tumors in the neck and head has high hopes. However, these developments have been overshadowed by claims by Genivent Sciences and Arbutus Biopharma that Moderna used its LNP technology without a license. Given Moderna's current state, I think a pullback from the stock is far from over. So, I am neutral on it.

Disclosure