Sound Hound AI The stock market has been red hot in 2024, with an impressive 288 percent gain so far. Investors are buying shares of the voice artificial intelligence (AI) solutions provider on the belief that it could become the next big AI play.

The company’s revenue is growing at an impressive pace, and it also boasts a solid pipeline that can help it sustain its red-hot growth in the future. What’s more, SoundHound AI stock has received a vote of confidence from AI pioneers. Nvidia (NASDAQ: NVDA ), which has a small stake in the company. That’s a big reason why SoundHound shares have soared so easily over the past month or so.

However, investors looking to buy AI stocks now may not be comfortable paying 42 times sales for SoundHound, which is much higher than the tech sector average of 7.1. Of course, it could become a major player in the AI market in the long run, but SoundHound AI is currently quite small, and far from profitable. Instead, investors would do well to buy shares of the following two established AI companies, which appear to be undervalued.

1. Nvidia

You might be wondering how Nvidia is an undervalued AI stock — it’s trading at 36 times sales, which isn’t much cheaper than SoundHound. But a closer look at how fast Nvidia is growing makes it clear that investors are getting a good deal on the stock right now.

In the fourth quarter of fiscal 2024 (for the three months ending January 28, 2024), Nvidia’s revenue grew a cumulative 265% year over year. Its adjusted earnings grew at a faster pace of 486% year-over-year to $5.16 per share. For comparison, SoundHound AI’s revenue rose 80% year-over-year to $17.1 million last quarter, while its adjusted loss halved to $0.07 per share on a year-over-year basis.

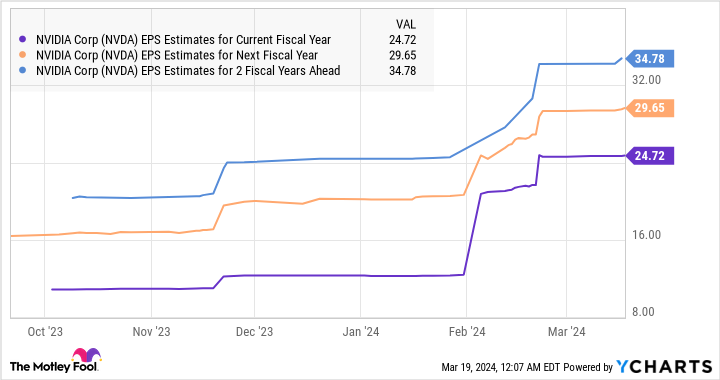

What’s even more impressive about Nvidia is that the chipmaker’s impressive growth is probably here to stay. Its revenue guidance of $24 billion for the first quarter of fiscal 2025 means that Nvidia’s revenue has once again more than tripled from the $7.2 billion level in the year-ago period. Analysts have sharply increased their growth estimates. They expect Nvidia’s earnings to nearly triple from the fiscal 2024 level of $12.96 per share in just three fiscal years.

This forecast for rapid growth in Nvidia’s earnings is exactly why the stock is trading at an attractive forward earnings multiple. This is evident from the following chart:

At 30 times its fiscal 2027 earnings, buying Nvidia stock is a no-brainer right now, as it trades at roughly the Nasdaq-100’s forward earnings multiple of 29 (as a proxy for tech stocks using an index on). Another clear indication of Nvidia’s undervalue is its price/earnings growth ratio (PEG ratio) of just 0.13. It is a forward-looking valuation metric that helps understand how cheap a stock is relative to the growth it is expected to see.

Traditionally, stocks with a PEG ratio of less than 1 are undervalued. Nvidia’s PEG ratio is well below that mark. All of this suggests that investors should consider buying Nvidia Handover Fist, as it is solidly positioned to take advantage of the lucrative long-term growth opportunities in AI chips and deliver healthy gains in the long run. is in position.

2. Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing (NYSE: TSM )TSMC, known as TSMC, is trading at 10 times sales and 26 times trailing earnings. That means the Foundry giant’s shares are much cheaper than shares of both Nvidia and SoundHound AI.

Considering the important role that TSMC is playing in enabling the AI chip revolution, investors would do well to get their hands on the stock before it gets expensive. After all, Nvidia wouldn’t have been able to run away from the AI semiconductor market without TSMC’s help. Nvidia is a non-core semiconductor company, meaning it only designs chips but doesn’t manufacture them. TSMC, Nvidia’s foundry partner, does the actual manufacturing of AI chips.

It’s worth noting that TSMC is the world’s largest foundry company, with a massive 61% share. That’s far ahead of second-placed Samsung’s 11 percent share. With the AI chip market forecast to grow at 38% annually through 2030, TSMC’s dominant position in the foundry space puts it in an advantageous position to take advantage of the growth opportunities on offer.

This is especially true considering that the leading AI chip players are TSMC customers. From Nvidia AMD To Intel, multiple chipmakers are lining up to buy chips made using TSMC’s advanced manufacturing processes. This is why TSMC is focused on aggressively expanding its monthly manufacturing capacity of AI chips to meet the growing demand from multiple customers.

Consequently, it would not be surprising to see TSMC grow at a faster pace than market expectations through 2024 and beyond. That’s probably why TSMC’s consensus earnings estimates are rising.

Assuming TSMC manages to reach $9 per share in earnings in 2026 and currently trades at 29 times earnings (according to the Nasdaq-100’s forward earnings multiple), its stock price could go as high as $261. That would be a 91% increase from TSMC’s current stock price.

TSMC’s current earnings multiple is lower than the Nasdaq-100 average, which means investors are getting a solid deal on this AI stock right now. They may not want to miss out on this opportunity as the stock could deliver impressive gains over the next three years.

Should you invest $1,000 in Nvidia right now?

Before buying stock in Nvidia, consider this:

gave Motley Fool Stock Advisor The analysis team only indicated what they believed. 10 Best Stocks For investors to buy now… and Nvidia wasn’t one of them. 10 stocks that made the cut could generate monster returns in the coming years.

Stock Advisor Provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular updates from analysts, and two new stock picks each month. gave Stock Advisor The service has more than tripled the return of the S&P 500 since 2002*.

See 10 stocks

*Stock Advisor returns till March 21, 2024.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short May 2024 $47 calls on Intel. The Motley Fool has a Disclosure Policy.

Forget Soundhound AI: Here Are 2 Artificial Intelligence (AI) Stocks That Are Undervalued Originally Posted by The Motley Fool