Arista Networks

Arista Networks

a net

$6.29

2.21%

43%

IBD Stock Analysis

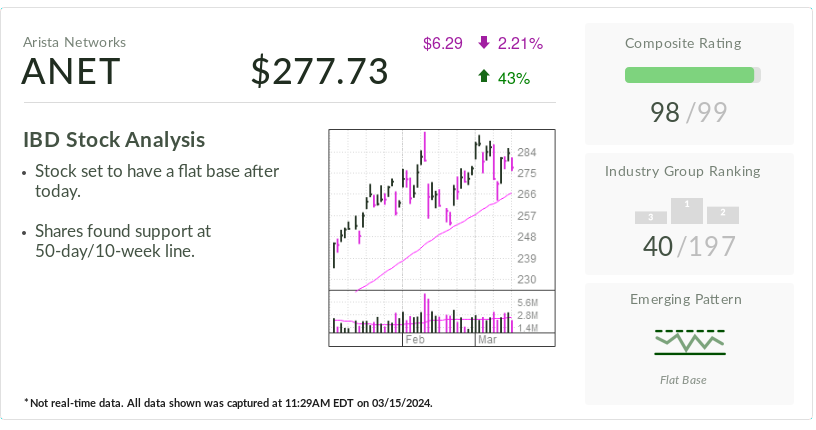

- Stocks should have a flat base after today.

- Shares found support at the 50-day/10-week line.

Industry Group Rankings

The emerging pattern

Flat base

* Not real time data. All data shown was retrieved on 03/15/2024 at 11:29AM EDT.

Arista Networks (ANET) is the IBD stock of the day as the computer networking firm builds on a flat base that makes it viable. Arista stock is up 18% in 2024 and 81% over the past year.

x

In the stock market today, ANET stock fell 2.2% to close at 277.73. Arista stock has an entry point of 292.66 from a flat base.

From a technical perspective, Arista stock found support above its 50-day moving average this week. This is a bullish signal.

Like a chipmaker Nvidia (NVDA), Arista is seen as a play on artificial intelligence investments by technology companies and cloud computing giants. Amidst the rise of generative AI, Internet data centers will require more computing power and network bandwidth.

One issue that has focused on its valuation for investors in ANET stock is how much AI-powered gear orders will re-accelerate sales growth in 2025. Arista Management predicts $750 million in AI-related sales by 2025.

ANET Stock: Meta, Microsoft’s biggest customer

Arista sells computer network switches that accelerate communication between racks of computer servers packed into “hyperscale” data centers. These Internet data centers are designed to accelerate computing horsepower when demand increases.

Arista’s biggest customers are Facebook parents. Meta platforms (META) and Microsoft (MSFT). Microsoft is the largest investor in startup OpenAI. In November 2022, OpenAI launched its ChatGPT Internet search software.

ChatGPT is part of a wave of creative AI technologies that can disrupt many industries by automating text, images, video and computer programming code.

Oracle (ORCL) and of the alphabet Google ( GOOGL ) is Arista’s new customer, analysts say.

rival of Cisco Systems (CSCO), Arista is gaining ground in the so-called enterprise market — large companies, government agencies and academic institutions.

Income growth slows

KeyBanc Capital analyst Thomas said, “The enterprise ticked up in Q4 2023 and is now close to 40% of revenue by our math as Arista continues to execute on share gains and new product offerings, including $30 billion enterprise segment including campus and routing addressed,” said KeyBanc Capital analyst Thomas. In a recent report. “Arista’s AI efforts are in the early stages with trials in 2023 and pilots in 2024 moving toward production in 2025.”

Aside from investing in AI infrastructure, one issue for Arista stock is that cloud computing companies are spending less on data center gear.

Arista’s revenue grew more than 48 percent in 2022 as Facebook and others ramped up data center spending. In 2023, revenue grew by 34 percent.

For 2024, analysts polled by FactSet project sales to increase by just 12 percent to $6.6 billion currently. In 2025, analysts expect sales to grow 15% to $7.59 billion.

For the three months ended Dec. 31, Arista’s earnings rose 48% to $2.08 per share. Profits increased with lower taxes. Also, analysts estimated Arista’s earnings per share to be $1.70 on an adjusted basis.

Arista Stock Technical Ratings

In addition to backbone switches, Arista also sells Ethernet devices built into computer networks. In July, Arista joined Cisco, Hewlett Packard Enterprise (HPE) and other companies to form the Ultra Ethernet Consortium.

Moreover, the group is supporting a new computer networking standard. Meanwhile, the consortium expects standards-based products to be available in 2024.

Also, according to IBD Stock Checkup, ANET stock owns a composite rating of 98 out of the best possible 99.

ANET stock has an accumulation/distribution rating of B. This rating analyzes the price and volume changes in the stock over the last 13 weeks of trading. Also, its current rating suggests that more funds are buying than selling.

The ratings, on a scale of A+ to E, measure institutional buying and selling in stocks. A+ signifies a heavy institutional buy. E stands for Heavy Sale. Consider the C grade neutral.

Follow Reinhardt Krause on X, first Twitter @reinhardtk_tech For updates on artificial intelligence, cybersecurity and cloud computing.

You may also like:

IBD Digital: Unlock IBD’s premium stock lists, tools and analysis today.

Learn how to time the market with IBD’s ETF Market Strategy.

IBD Live: A new tool for daily stock market analysis

Want to make quick profits and avoid big losses? Try SwingTrader.

Market rally pauses ahead of Fed, two big AI events