After the market closed, Nvidia's 10-for-1 stock split, announced during the company's recent earnings call in May, went into effect. But that will do little to change the company's $3 trillion valuation or its fundamentals, which, until now, have investors licking their wounds.

“You and I know that stock splits are only cosmetic, at least for existing shareholders,” says Paul Meeks, a veteran tech investor and professor at The Citadel's military college business school. “With their investor relations routine, Nvidia is well aware that they have to keep throwing investors some bones out there”.

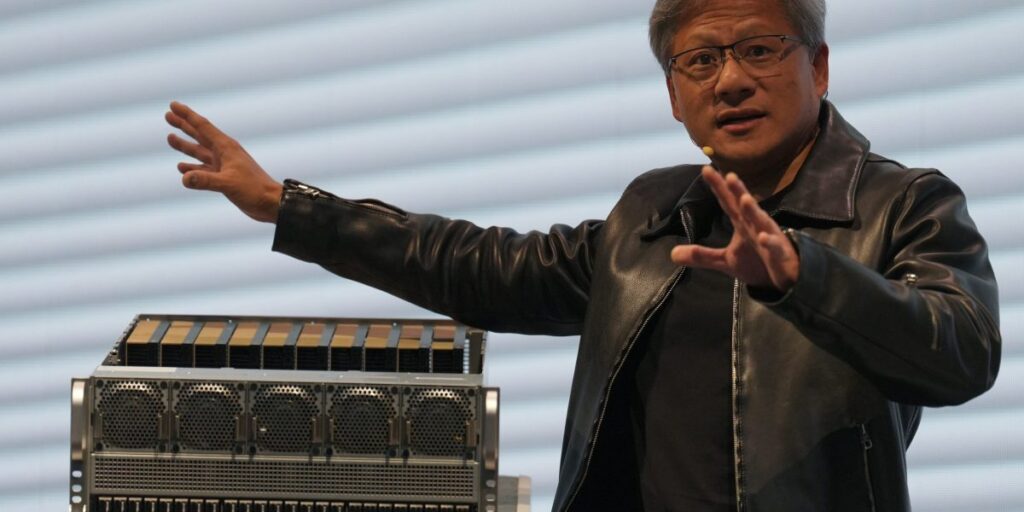

Few other companies have embodied the pecking order of the new corporate hierarchy triggered by the spread of AI quite like Nvidia. The company's stock is up 3,174% over the past five years and 218% in the past year alone. During its epic run, Nvidia's market cap surpassed the likes of Amazon and Alphabet. Before the 10-for-1 split, the stock was at $1,209.

According to Humayun Shaikh, CEO of startup Fetch.ai, which provides developer tools specifically for AI, the price was likely too high for most investors, given that the distribution is aimed at retail. Investors had to be attracted. “A stock split increases Nvidia's attractiveness by making shares more affordable, thereby broadening its investor base,” he said.

Shaikh also sees the move as, at least in part, investor feedback, saying it's likely “optics-driven” and could accelerate market cap growth.

Nvidia's position as the firm that has cornered the market on providing AI developers with all the chips and computing power they need isn't changing due to the stock split. In the first quarter, Nvidia's sales rose 262% year over year to $26 billion, beating Wall Street's already lofty expectations.

Nvidia's stock rally also serves as an indication of what the AI boom may still have in store.

“The movement in Nvidia's price over the past year is telling us something about the market, namely that AI may be the new general-purpose technology, like the Internet or electricity, that will have large-scale productivity impacts across the economy. And that's why AI companies benefit a lot,” said NYU Business School professor Vasant Dhar.

What could possibly go wrong with Nvidia's stock split?

Still, investors are considering a few scenarios in which things could go south for them after the stock split, even as they admit the odds are slim.

For Max, the only thing that could stop Nvidia from climbing to the top is a slowdown in the economy, which he sees as unlikely as he expects the US to avoid recession and that the Federal Reserve It will cut interest rates as early as 2025. In fact, he's already thinking about Nvidia's performance should the economy improve.

“It's going to be hard for these stocks to lose their gains if we're suddenly on the back foot with low rates in our face at high speed,” Max said.

Meanwhile, Shaikh said the division's aim to attract retail investors is another possible, but unlikely, concern. Individually, retail investors may hold small amounts of Nvidia stock. But collectively, they can make up a significant portion of the stake. So a shock to the system or an unexpected change in their perception of the company can still have a significant impact. One need look no further than GameStop to understand the massive influence retail investors have on the market.

Devaluing a stock to a tenth of its value can be a double-edged sword. “This approach may appeal to Robin Hood-type investors or meme-stock enthusiasts,” Sheikh added. “However, if the narrative turns against Nvidia and speculative traders start selling, this could negatively impact the price.”

But even if this undesirable scenario happens, it won't change all the market trends driving the chipmaker.

“Nvidia's value has already risen enormously, so any tailwind from the stock split will pale in comparison to the 'fundamental' reasons for its performance,” Dhar said.