(Bloomberg) — Micron Technology Inc.'s $62 billion artificial intelligence-driven rally is about to face a test of whether it jumped too fast.

Most Read from Bloomberg

The chipmaker's shares are up nearly 65 percent this year. Much of that advance has come since Micron's last quarterly report, sending the stock to an all-time high this month. Investors will look for evidence of earnings growth and solid future demand in the next release after Wednesday's market close. Stocks rose about 0.5 percent in New York on Wednesday afternoon.

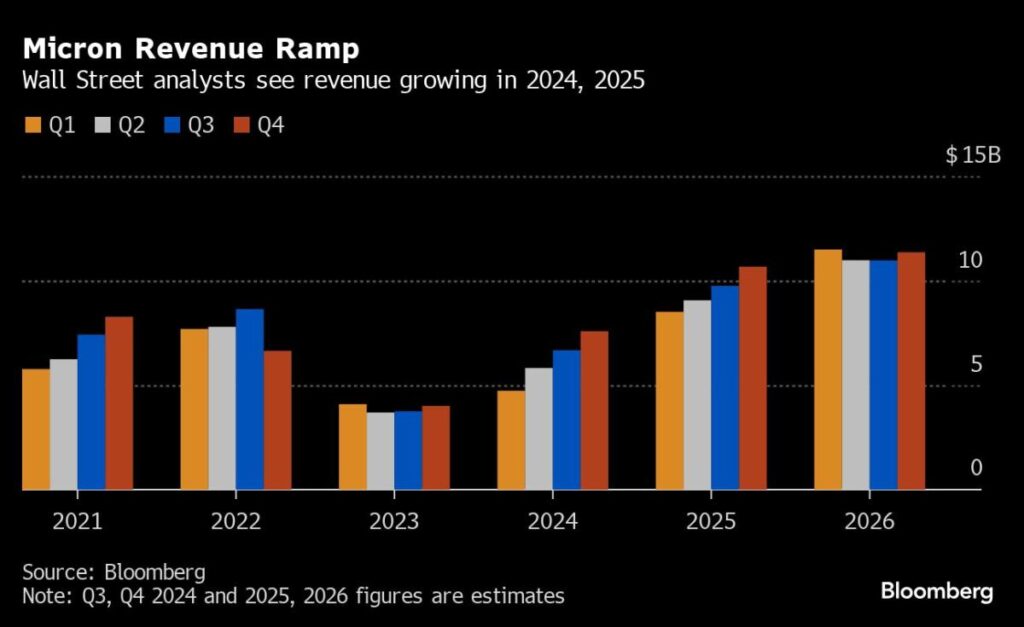

Expectations are high. Wall Street reported Micron reported revenue of $6.7 billion in the quarter, up nearly 80 percent from the same period a year ago. The decline could raise the risk of a selloff, according to data compiled by Bloomberg, with options contracts indicating the stock could rise 12 percent in either direction in the trading session after earnings.

Jay Woods, chief global strategist at Freedom Capital Markets, said Micron has “taken off the coat tails of the whole AI phenomenon.” “They really have to have a story that sets them apart from their peers.”

Where Micron stands out is in its memory capabilities, used in AI applications, which Wall Street sees as driving future revenue. Analyst estimates for quarterly adjusted earnings per share rose 9.5% to 50 cents in the past three months.

“We expect Micron to deliver a beat-and-rise as we enter one of the biggest memory cycles in history,” Rosenblatt Securities Inc.'s Hans Moseman wrote in a Tuesday note. He added that this growth will be driven by factors including the demand for artificial intelligence applications and the increase in high-bandwidth memory chips, which in turn reduces the supply of traditional dynamic random access memory components.

At $225, Mossman's price target for Micron is the highest on Wall Street, according to data compiled by Bloomberg. The company has a total of 37 buy ratings, two holds and one sell.

Still, in desperation, JPMorgan Chase & Co. led by Harlan Sour. According to analysts, any potential post-earnings weakness could be a good time to snap up shares.

“We would use any near-term pullback in the stock to rally shares,” the analysts wrote in a June 24 note, adding that they expect the current memory segment's recovery to push the stock above current levels. Looking at $190 to $200 shipped. A part

Tech chart of the day

Shares of Nvidia Corp. rose 6.8 percent on Tuesday, their best one-day gain since late May, snapping a three-day losing streak that wiped out $400 billion in market value. Damaged more than Shares were lower in intraday trading on Wednesday.

Top Tech News

-

OpenAI's sudden move to restrict access to its services in China portends a change in the industry, as Baidu Inc. Local AI leaders ranging from Alibaba Group Holding Ltd. are stepping up to take the field further.

-

Troubled French IT firm Atos SE said Onepoint, its biggest shareholder, had pulled out of bailout talks and billionaire Daniel Kratinsky's EPEI had expressed interest in resuming talks.

-

Adventist Corp will benefit as AI advances make chips more complex in the coming years, fueling demand for semiconductor testing equipment, the company chief said.

-

The Biden administration plans to award $75 million in semiconductor subsidies to Integris Inc., the first grant to the company focused on supplying components to chip factories and a broader push to bring production back to the U.S. The latest in pressure.

-

SoftBank Group Corp. founder Masayoshi Son will outline plans to bring AI-influenced medical care to Japan, making a rare public appearance to drive home its resurgent ambitions in artificial intelligence.

Income is due on Wednesday.

– With help from Subrata Patnaik and Stephen Kirkland.

(Updates throughout stock movement)

Most read from Bloomberg Businessweek.

©2024 Bloomberg LP