The race to develop the infrastructure to power generative artificial intelligence (AI) applications has accelerated following these reports. Microsoft (NASDAQ: MSFT ) And OpenAI is expected to invest $100 billion to $115 billion in a new supercomputer called Stargate, according to tech-focused business publication The Information.

While Microsoft and OpenAI themselves have not released any details, the two companies are reportedly in the third phase of a five-phase project, of which Stargate is the fifth phase. The article suggests that a significant portion of the project’s budget is likely to be spent on semiconductors, and the goal is to have the supercomputer online in 2028.

To put things in perspective, Stargate could be 100 times more expensive than what it currently costs to build a large data center, and the project is expected to cost three times more than Microsoft’s capital expenditures last year. shall be. There’s a solid way for investors to capitalize on this potentially massive AI investment from Microsoft. Arm Holdings (NASDAQ: ARM ).

Microsoft’s deployment of custom chips based on Arm’s design could boost the latter.

Arm Holdings is a British chip designer that licenses its intellectual property to semiconductor companies and original equipment manufacturers, who then customize Arm’s instruction set to produce chips to their specifications and needs. . Its IP is used to manufacture central processing units (CPUs), graphics processing units (GPUs), neural processing units (NPUs) and interconnect technologies.

According to Arm, more than 70 percent of the world’s population uses products based on its intellectual property. This is not surprising: almost all of the world’s smartphones run on ARM-based processors, while 50% of CPUs are built using its instruction sets. The company has two sources of revenue: licensing and royalties. It collects licensing fees from customers after selling their intellectual property. Customers also pay Arm royalties for each chip they ship that contains its technology.

Microsoft’s new effort could be a tailwind for Arm’s business. In November, Microsoft introduced its first in-house custom AI CPU, Azure Cobalt. This custom CPU arm is based on the Newverse CSS platform. Arm says Cobalt can “address some of the biggest and most complex challenges that infrastructure will face, from AI to sustainability.”

Tech sector news site The Next Platform predicts that Microsoft will try to reduce its reliance on the likes of Microsoft. Nvidia By deploying future generations of Cobalt processors to the Stargate. This will come as no surprise, as custom AI processors not only save money on capital expenditures and power costs for cloud companies, but also provide better performance. Microsoft, for example, said it saw up to a 40 percent increase in performance after deploying the first generation of Cobalt chips.

Considering the massive amount of power a supercomputer the size of Stargate would require, Microsoft would pack plenty of power-efficient custom chips like Cobalt into it instead of power-hungry GPUs. As a result, the arm’s AI-related revenue is likely to decline as Microsoft builds its ambitious supercomputer.

The stock is already poised to deliver solid gains.

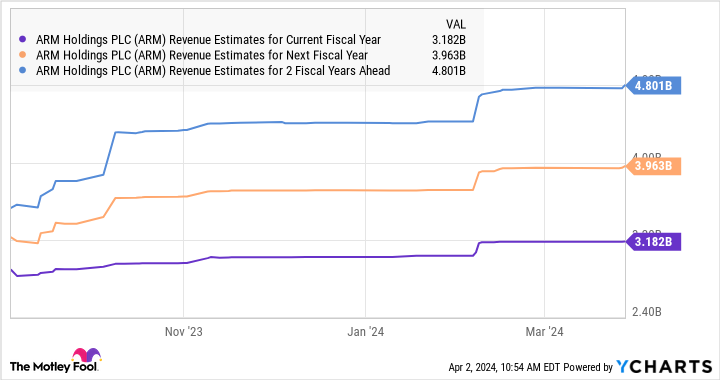

The good news is that Arm is already benefiting from its adoption of AI chips, but Microsoft’s big project could provide another catalyst that leads to stronger top-line growth than analysts expect.

The current consensus estimates Arm’s earnings to grow at an annual rate of around 45% for the next five years. If that proves true, its bottom line will reach about $7.63 per share after five years (using its projected fiscal 2024 earnings of $1.19 per share as a base). If we multiply this expected income figure by Nasdaq-100At a forward earnings multiple of 27.3 (using the index for tech stocks as a proxy), we get a projected stock price for Arm of $208 in five years — up 69% from current levels.

However, Microsoft’s earnings could be even stronger due to Stargate-driven demand, which is why investors looking to buy AI stock would be better off buying Arm before it gets more expensive. Increase.

Should you invest $1,000 in Arm Holdings now?

Before buying stock in Arm Holdings, consider this:

gave Motley Fool Stock Advisor The analysis team only indicated what they believed. 10 Best Stocks For investors to buy now… and Arm Holdings was not one of them. 10 stocks that made the cut could generate monster returns in the coming years.

Stock Advisor Provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular updates from analysts, and two new stock picks each month. gave Stock Advisor The service has more than tripled the return of the S&P 500 since 2002*.

See 10 stocks

*Stock Advisor is returning from 1st April 2024.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions and recommends Microsoft and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a Disclosure Policy.

Microsoft’s $100 Billion Generative Artificial Intelligence (AI) Splurge Could Send This Stock Soaring was originally published by The Motley Fool.