Utility play Vastra ( VST ) added to the S&P 500 index Wednesday morning after the company reported a decline in revenue and earnings in the first quarter. The Vistra stock market plunged after the open before rising sharply.

X

VST has gained more than 100% in 2024 and is now with fellow S&P 500 stocks. Constellation energy (CEG) as power generation companies looking to meet the demand for artificial intelligence (AI) data centers.

Vistra saw first-quarter earnings of 62 cents per share, in line with expectations and down 45% from a year ago. Meanwhile, Vistra Q1 revenue fell 31% to $3.054 billion, compared to analysts' expectations of $2.92 billion in sales. The company noted that this was “another quarter characterized by both winter storms and unseasonably mild weather.”

“Recent power market developments are certainly noteworthy, and we see multiple drivers of the expected long-term acceleration in load growth in many of our geographies,” Vistra Chief Executive Jim Burke said in Wednesday's earnings release. is pregnant.”

Vistra stock fell more than 5 percent before the market opened. However, shares of VST rose 9.2 percent to 89.21 during market trade on Wednesday. On Tuesday, VST fell 1.8% to 81.74.

At the end of the fourth quarter, Burke named data centers as part of the company's growth plans.

Vistra's earnings come ahead of Constellation Energy, which announced first-quarter revenue and earnings earlier Thursday. Analysts expect a 400% EPS gain, but investors may be more focused on how AI data centers will increase demand for the company.

AI is going nuclear.

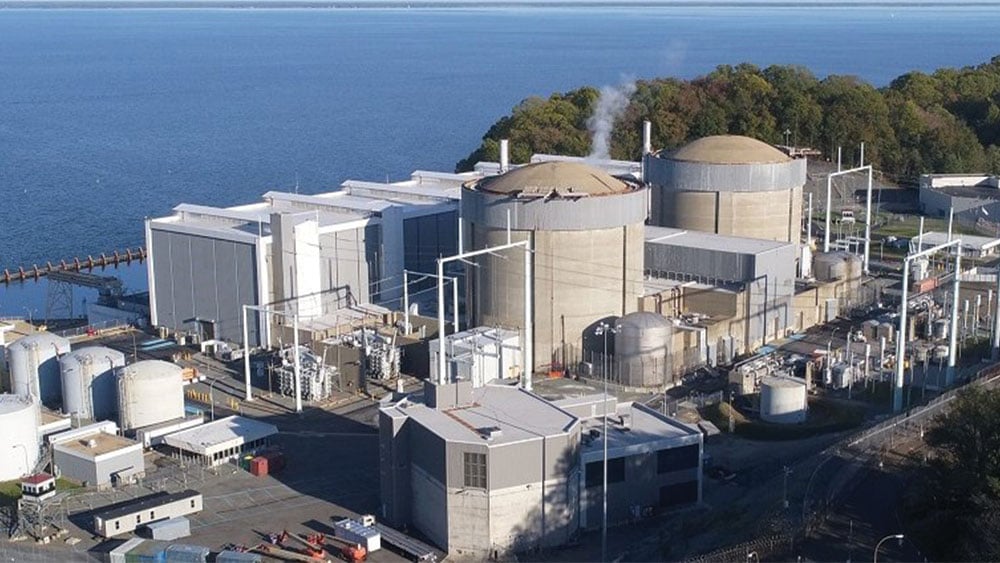

Constellation Energy's earnings are forecast to rise 417% to $1.50. The first quarter sees sales rise 9% to $8.23 billion. But more than earnings growth, analysts are eyeing whether Constellation, the largest U.S. nuclear power plant operator, announces long-term contracts to install AI data centers at its nuclear plants. .

Amid the AI gold rush, companies are hungry for the energy needed to power data centers. Data centers, in turn, serve as training and distribution centers for the machine learning that drives AI.

Nuclear power is one such answer.

Morgan Stanley analyst David Arcaro expected the conference call to “focus on the company's ability to sign long-term contracts with data centers at nuclear plant sites,” according to an April 29 note.

Arcaro added that negotiations have progressed in recent months. He believes Constellation Energy could sign contracts as early as the third quarter.

“Discussions with major hyperscalers have reached site-level due diligence and management has previously indicated that potential deals could be done in months, not years,” a Morgan Stanley analyst said. said The top hyperscalers – the largest cloud, data center and AI providers – are included. Amazon.comof (AMZN) AWS, Microsoft (MSFT) Meta (META) and the alphabet (GOOGL).

In March, Talen Energy announced the sale of a 960-megawatt data center campus to AWS for $650 million, located at its Pennsylvania nuclear plant.

S&P 500: Constellation Energy Stocks

Constellation Energy stock rose 3.7% to 208 on Wednesday after rising 1.5% to 200.56 on Tuesday.

In 2024, CEG is expected to increase by about 70%. It has been one of the best-performing stocks in the S&P 500 index this year, behind Nvidia (NVDA) and Super Microcomputer (SMCI).

According to the market surge chart, CEG shares are trading above the official flat base 198.83 buy point. On Feb. 27, when Constellation Energy reported Q4 earnings, CEG shares rose nearly 17%.

Founded in 1999, Nakshatra Energy has gone through many phases. After first operating as a public company, it merged with Exelon in 2012 as part of a nearly $8 billion deal. With Exelon, the company's moniker became Constellation Energy Generation. It then split from the utility giant in early 2022.

Constellation Energy owns 25% of US nuclear power reactors. Moreover, it supplies energy to more than 20 percent of the country's large commercial and industrial consumers.

Nuclear power has declined in recent years, with 13 plants closed since 2013. The industry faces safety concerns about the storage of fuel rods, potential radiation leaks and other environmental issues. The cost of building new nuclear power plants has become prohibitive as cheaper and more competitive energy sources – including wind, solar and natural gas – have gained popularity.

AI is not just nuclear for data centers.

during this, Chevron (CVX) Chief Executive Mike Worth told CNBC on Monday that he expects demand for natural gas to increase as power needs from artificial intelligence and AI data centers increase.

US electricity demand is predicted to grow by 20% by 2030. According to a recent analysis by Wells Fargo, AI data centers alone could increase electricity demand by about 323 terawatt hours by the beginning of the next decade. For comparison, New York City's annual electricity consumption is about 50 terawatt hours.

Goldman Sachs expects data centers to account for about 8 percent of total U.S. electricity consumption by 2030.

Enverus estimates that as AI accelerates data center capacity, demand for natural gas will increase in the coming years.

“Data centers are the least sensitive to electricity prices, in our view, due to the strong economics of the core business (Big Tech), ability to pass costs on to consumers and intense competition among participants to win the AI race,” ” Enverus wrote in a May 1 note.

Please follow Kit Norton on X, formerly known as Twitter, @KitNorton For more coverage.

You may also like:

Is Tesla Stock a Buy or a Sell?

Get full access to IBD stock lists and ratings.

Learning how to pick great stocks? Read Investor's Corner

Is Raven buying now after launching their new product line?

Futures: AppLovin, Robinhood Lead 9 Earnings Movers