(Bloomberg) — Nokia Oyj to acquire Infinera Corp. in $2.3 billion deal has agreed to buy which will expand the company's networking products for data centers and increase its presence in the U.S., a potentially key source of growth as artificial intelligence drives rapid growth. Server capacity demand

Most Read from Bloomberg

“AI is currently driving significant investment in data centers, and one of the key focuses of this acquisition is that it adds to our exposure to data centers,” Nokia Chief Executive Officer Pekka Lindmark said in a call with reporters on Friday. adds significantly.”

Infinera's exposure to “server-to-server communications” within data centers is particularly attractive because it will be “one of the fastest-growing segments in the overall communications technology market.”

The takeover will value the optical telecommunications maker's equity at $6.65 a share, the companies said in a statement late Thursday. At least 70 percent of the deal will be paid in cash, with the rest consisting of Nokia's U.S. depository shares, according to the statement, which confirmed an earlier report by Bloomberg News.

Infinera's stock was up 15% over the past 12 months, giving the company a market value of about $1.2 billion. The shares, which closed Thursday at $5.26 each, jumped nearly 20 percent in premarket trading Friday before exchanges opened in the U.S. Nokia shares rose 1.1 percent to €3.54 in Helsinki at 12:11 p.m.

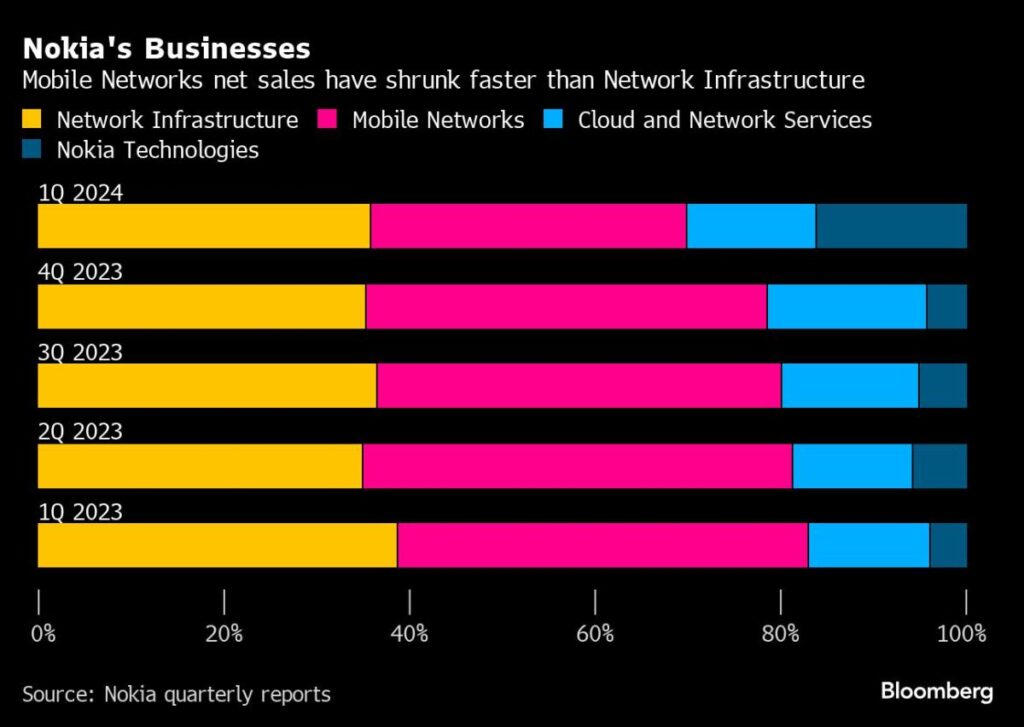

Sales of Nokia and rival Ericsson AB have been hit by a dramatic decline in mobile network spending as the industry struggles to recoup investment. Nokia also suffered a major blow when Ericsson bought AT&T Inc. in December. won a $14 billion contract to build an OpenRAN network with

The deal, Nokia's biggest since its €10.6 billion ($11.4 billion) takeover of Alcatel-Lucent in 2016, will help boost the network's fixed-line business, which the company expects to grow in the second half of the year. Pickups will increase as customer orders increase. Technology used in cloud infrastructure.

Infinera and its rivals have also suffered from weak spending. The company reported that revenue fell by about a third between the fourth quarter and the first quarter of this year and swung into a net loss, missing analysts' estimates in May financial results. Major competitors Cisco Systems Inc. and Ciena Corp. also reported contract revenue in the most recent quarter.

Still, Infinera said it won an important new customer and CEO David Hurd said the business is positioned to take advantage of significant changes in the industry, including the proliferation of data centers and AI workloads.

“It's a great time, to buy something before the market starts to recover,” Lundmark said in an interview on Friday. He said that the optical market has been weak for the past two years, although Nokia and analysts are predicting that the market will recover in 2025.

What Bloomberg Intelligence Says:

Ciena and Cisco could face tough competition in the high-speed data center interconnect market with the Nokia-Infinera combination. The deal gives Nokia market-leading high-speed optical technologies that better position it with cloud accounts, while alleviating Infinera's balance sheet concerns, giving it the resources to acquire telecom and cloud customers. Provides.

– Woo Jin-ho, BI's Senior Industry Analyst for Technology

Nokia also said in a separate statement on Thursday that the French government plans to buy its Alcatel Submarine Networks unit, with an enterprise value of €350 million. Lundmark said in an interview on Friday that the company, which operated largely independently and had a long sales cycle, did not fit well with the rest of Nokia's operations. The sale allows the company to focus on and strengthen its network infrastructure unit.

PJT Partners acted as financial advisor to Nokia, while Infinera was advised by Centerview Partners LLC.

— With assistance from Dinesh Nair, Katie Pohjanpalu and Michelle F. Davis.

Most read from Bloomberg Businessweek.

©2024 Bloomberg LP