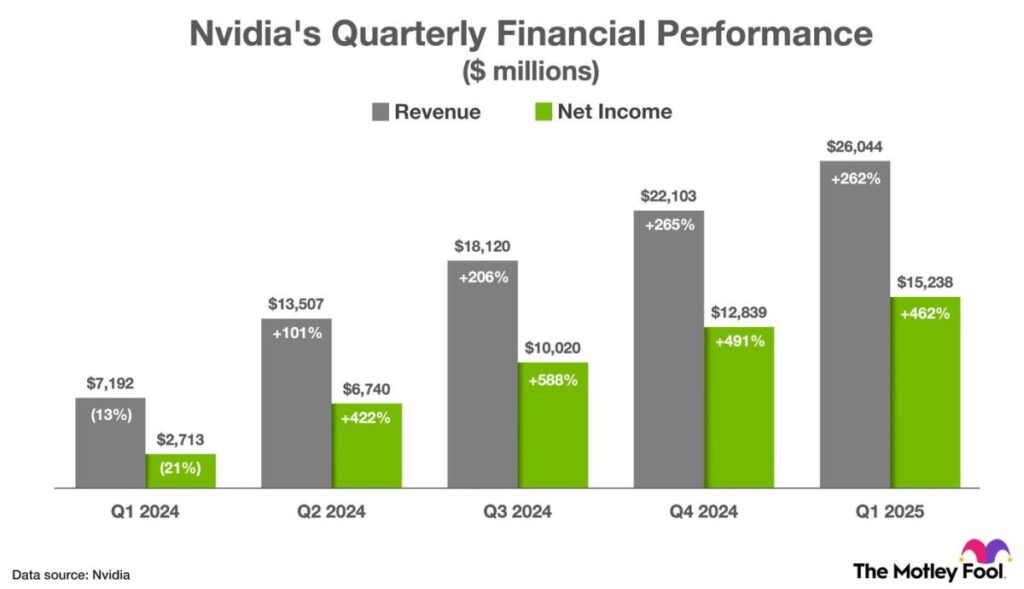

Nvidia (NASDAQ: NVDA ) Blockbuster first quarter results reported. Revenue more than tripled due to phenomenal demand for its high-speed computing chips and systems, particularly generative artificial intelligence (AI). Meanwhile, adjusted earnings grew more than fivefold.

Just as interesting, Nvidia also announced a 10-for-1 stock split — its second in less than three years — that will take place after the market closes on Friday, June 7, 2024. Shareholders will receive nine new shares. for each share they currently own. The stock will begin trading on a split-adjusted basis when the market opens on Monday, June 10, 2024.

Investors should understand that the stock split will not affect Nvidia's price, nor will it affect the investment position. For example, if a shareholder owns one share worth $1,000 before the distribution, they will own 10 shares worth $100 after the distribution. There will be no change in their shares in the company. But stock splits can still create value for investors.

In particular, stock splits usually follow substantial increases in share prices, and rarely happen by accident. Instead, value appreciation often points to a company with a competitive advantage that has the best growth prospects. Nvidia certainly fits that mold, as it does. Service Now (NYSE: NOW )an AI-focused software company that may split its stock next.

Here's what investors should know.

Nvidia has a strong competitive position in a rapidly growing market.

Nvidia graphics processing units (GPUs) are synonymous with advanced graphics in multimedia and fast computing in data centers, especially where artificial intelligence (AI) is concerned. The company commands over 95% market share in workstation graphics processors and over 90% market share in data center GPUs.

Furthermore, The Wall Street Journal It was recently reported that “Nvidia's chips dominate all the latest AI systems, giving the company over 80% market share.” That bodes well for Nvidia and its shareholders because AI spending on hardware, software and services is predicted to grow 36 percent annually through 2030, according to Grandview Research.

One of the reasons Nvidia is so successful is its ecosystem of support software. Chief among these products is CUDA, a programming model that allows GPUs to accelerate all sorts of tasks. But Nvidia also offers subscription software and cloud services that support the development and deployment of AI applications across a variety of use cases. The company has further expanded its presence in data centers by branching into networking hardware and central processing units (CPUs), both of which are booming product lines.

In short, Nvidia provides a full-stack accelerated computing system — comprising hardware, software and services — for AI applications and other data center workloads. That strategy, along with its unmatched technological prowess, provides the company with a material competitive advantage that has supported strong financial results on a relatively consistent basis.

The chart below shows Nvidia's revenue and non-GAAP net income growth over the past five quarters.

ServiceNow could be the next artificial intelligence company to split its stock.

ServiceNow stock is up 1,130% over the past decade and 145% over the past five years. S&P 500 (SNPINDEX: ^GSPC) In both cases. This share price appreciation qualifies the company as a stock split candidate but, more importantly, it highlights ServiceNow as a competitive advantage company with excellent growth prospects, similar to Nvidia. Is.

ServiceNow's platform helps enterprises digitize and automate work across departments. The company is known for its IT software products. Specifically, ServiceNow is the market leader in IT operations software for IT service management, IT operations management, and AI. However, the company also has a strong market presence in adjacent software verticals such as customer service, digital process automation, and low-code development.

ServiceNow has integrated AI into its products for years, such as intelligent document processing, sentiment analysis, and AI-powered search. Naturally, the company was quick to add creative AI capabilities to its products. Now Assist is a creative AI assistant that brings automation to IT service, customer service, human resources, and developer workflows. ServiceNow sees itself as “uniquely positioned to bring the full potential of creative AI to the enterprise.”

ServiceNow reported solid financial results in the first quarter. Revenue increased 24% to $2.6 billion and non-GAAP net income increased 44% to $3.41 per share. The stock fell after the report on soft guidance that slightly missed Wall Street expectations, but the company maintained its medium-term financial targets at its analyst day in May. Notably, management still expects its addressable market to grow at a 17 percent annual rate to $275 billion by 2026, and the company still believes that revenue will grow 20 percent annually over the same period. There will be an increase.

With that in mind, Wall Street expects the company to grow earnings per share by 30% annually over the next three to five years. This consensus estimate makes its current 68.8 times earnings (and 54.5 times adjusted earnings) seem quite affordable. In fact, ServiceNow shares have never been cheap. Investors should take advantage of this opportunity and buy a short position.

Should you invest $1,000 in Nvidia right now?

Before buying stock in Nvidia, consider this:

gave Motley Fool Stock Advisor The analysis team only indicated what they believed. 10 Best Stocks For investors to buy now… and Nvidia wasn't one of them. 10 stocks that made the cut could generate monster returns in the coming years.

Consider when Nvidia This list was created on April 15, 2005… If you invested $1,000 at the time of our recommendation, You will have $677,040.!*

Stock Advisor Provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks every month. gave Stock Advisor There is a service More than four times S&P 500 Returns since 2002*.

View 10 Stocks »

*Stock Advisor will return on May 28, 2024.

Trevor Genuine has positions in Nvidia. The Motley Fool has positions and recommends Nvidia and ServiceNow. The Motley Fool has a Disclosure Policy.

Nvidia just announced a 10-for-1 stock split in June. This artificial intelligence (AI) stock could be the next split. Originally published by The Motley Fool.