Key takeaways

- S&P 500 jumped 1.1% on Tuesday, March 12, 2024 Tech stocks headed for record close even as February CPI data warmed.

- Oracle shares rose after the results helped the software giant’s cloud business benefit from AI-related demand.

- Airline stocks fell as carriers warned that slower deliveries of new jets and higher fuel costs could hurt their performance.

Major U.S. equity indexes rose even as the latest inflation data showed that consumer prices rose more than expected in February, raising doubts about how soon the Federal Reserve will raise rates. Can reduce interest.

Signs of persistent inflation weren’t enough to derail the rallying tech sector, which sent the index higher once again. The S&P 500 rose 1.1 percent on Tuesday, posting an all-time closing high. The Nasdaq and Dow added 1.5% and 0.6%, respectively.

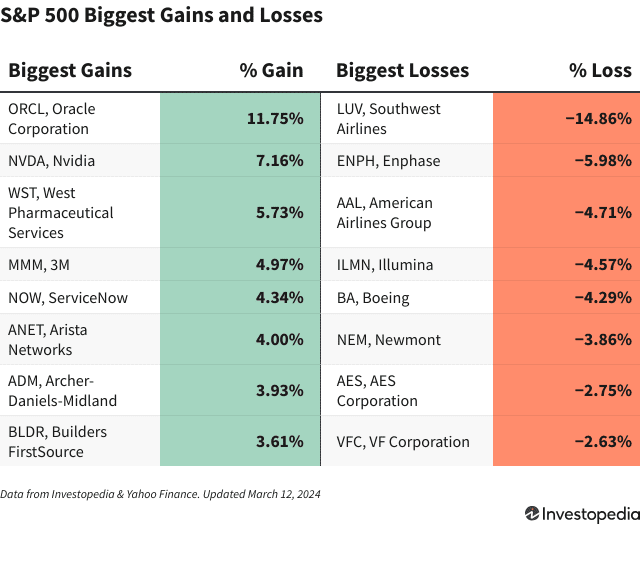

Shares of Oracle ( ORCL ) led the S&P 500 higher, rising 11.8 percent after the software giant beat estimates for quarterly profit, boosted by artificial intelligence (AI) demand for its cloud business. Benefited. Oracle also hinted at an upcoming joint announcement with customer and AI chip behemoth Nvidia (NVDA), whose shares rose 7.2% on the day. Shares of fellow enterprise cloud software provider ServiceNow ( NOW ) also rode the latest wave of AI optimism, rising 4.3 percent.

3M shares ( MMM ) rose 5.0% after the industrial group announced that William Brown, formerly head of L3Harris Technologies ( LHX ), will become its new CEO. Brown stepped into the role after a tumultuous year in which 3M settled several liability lawsuits.

Shares of Archer Daniels Midland ( ADM ) rose 3.9 percent after the agricultural firm resolved accounting issues that have been in the spotlight since the company launched an internal investigation in January. The company indicated that it has plans to address weaknesses in its pricing and reporting processes, ensuring greater transparency and reliability of its financial statements.

Airline stocks sank on Tuesday as several major carriers highlighted issues that could negatively impact their results. Southwest Airlines ( LUV ) said it will cut capacity due to lower-than-expected deliveries of new planes from Boeing ( BA ). Shares of Southwest fell 14.9 percent, the biggest loser on the S&P 500, while shares of Boeing fell 4.3 percent. Meanwhile, American Airlines ( AAL ) said higher fuel prices would affect current-quarter results, and its shares sank 4.7 percent.

Shares of Enphase Energy ( ENPH ) fell 6.0% after analysts at Piper Sandler lowered their price target on the stock, citing lower growth expectations for the solar technology company over the coming year.

Shares of Illumina ( ILMN ) fell 4.6% amid reports that activist investor Carl Icahn will no longer follow through on plans to replace additional directors on the DNA sequencing company’s board. Icahn filed a lawsuit last year claiming the Illumina board breached fiduciary duties, which is pending.