Sound Hound AI (NASDAQ:SOUN) The stock saw a big pullback in Thursday’s trading. Shares of the audio technology company closed down 3.2 percent in the daily session, according to data from S&P Global Market Intelligence.

Soundhound stock actually opened today’s trading session with a strong rally, and was up 18.5% in early trading. But the stock pulled back after comments from analysts at Neville, and it fell after news that U.S. inflation came in higher than expected.

Speaking on a podcast today, analysts at Navellier expressed concerns that SoundHound was a “pump and dump” stock. The firm’s team suggested that SoundHound’s valuation was unreasonably inflated and highlighted the fact that the average Wall Street analyst target now sees the business post a loss of $0.09 per share in the first quarter of this year. has called for a posting — a better-than-expected loss of $0.07 per share nearly two months ago.

Growth investors also got some bad news on the inflation front today. The producer price index (PPI) showed a month-on-month increase of 0.6 percent in February. Meanwhile, the median estimate had called for PPI to rise 0.3 percent on a monthly basis. At the same time, overall retail sales rose about 0.6% in the month – below economists’ target for 0.7% growth.

A combination of bearish coverage from Neville analysts and unfavorable macroeconomic data sent SoundHound stock down today, and shares were down as much as 12.7% in Thursday trading. Should Investors Buy Stocks on Pullbacks?

Soundhound AI Stock is a high-risk, high-reward game.

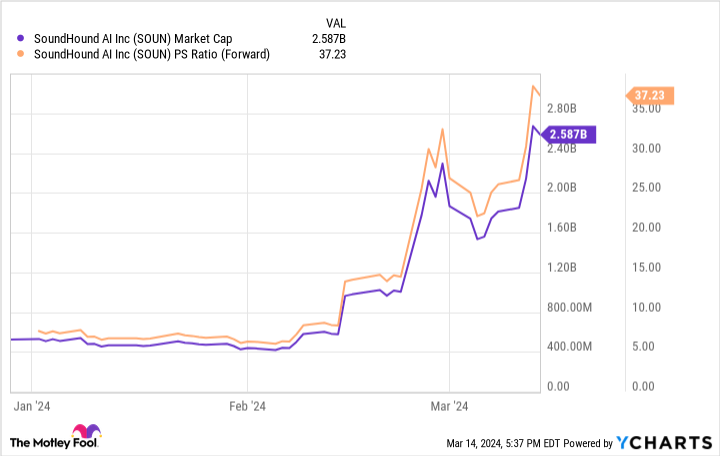

Today’s dramatic swings in SoundHound’s share price reflect the volatile nature of the stock at the moment. Audio Tech has become a battleground specialist. With a 295 percent share to date, Undoubtedly has been winning the battle recently. But the massive run-up to company valuations has made Soundhound a riskier bet, and even slightly negative news could accelerate the downside.

While SoundHound AI is growing revenue at a rapid pace, the company’s lack of profitability and high growth-dependent valuation make it one of the riskiest big-name AI stocks right now.

Valued at about $2.6 billion, Soundhound is trading at about 37 times this year’s expected sales. Investors are hoping that the company’s relatively small size and strong sales momentum will allow the stock to post explosive gains from current levels.

While it’s possible the bulls will continue to feast, I think investors should generally take a cautious approach to stocks at today’s prices. In addition to some very strong growth in the stock already, SoundHound’s current price still suggests a favorable macroeconomic backdrop going forward. Given the amount of speculation involved, the stock comes with considerable downside risk right now — even if explosive potential is still on the table.

Should you invest $1,000 in SoundHound AI now?

Before buying stock in SoundHound AI, consider this:

gave Motley Fool Stock Advisor The analysis team only indicated what they believed. 10 Best Stocks For investors to buy now… and SoundHound AI was not one of them. 10 stocks that made the cut could generate monster returns in the coming years.

Stock Advisor Provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular updates from analysts, and two new stock picks each month. gave Stock Advisor The service has more than tripled the return of the S&P 500 since 2002*.

See 10 stocks

*Stock Advisor returns till March 11, 2024.

Keith Noonan has no position in any stocks. The Motley Fool has no positions in any of the stocks mentioned. The Motley Fool has a Disclosure Policy.

SoundHound AI Fell Today — Is This Your Chance to Buy Explosive Artificial Intelligence Stock? Originally published by The Motley Fool.