The Dow Jones Industrial Average fell on Wednesday as inflation data came in hotter than expected, with the major indexes trading near session lows amid rising output. Artificial Intelligence Leaders Nvidia (NVDA) moved up despite a correction but fellow outstanding seven names Tesla (TSLA), apple (AAPL) and Microsoft ( MSFT ) struggled in the stock market today. And Warren Buffett stock signaled a selloff.

x

Meanwhile, some stocks were digging into close entries amid the negative action. ICIC Bank (IBN) and Exxon Enterprise (AXON) were trying to catch up. But there were several drawbacks.

The tech-heavy Nasdaq fell more than 1 percent in the stock market today. The costar ( CSGP ) lagged behind as it fell nearly 6%.

The benchmark S&P 500 also fell more than 1%. Additional storage space ( EXR ) was among the worst performers as it fell nearly 7%. Delta Airlines ( DAL ) was initially a bright spot on an earnings beat, but reversed and lost more than 2%. The Invesco S&P 500 Equal Weight (RSP) exchange-traded fund skidded about 2% amid broader weakness.

All sectors of the S&P 500 were in negative territory. Real estate and utilities, the latter a defensive area, struggled the most in the stock market today. Energy and communication services fell the least.

Small caps were getting hammered by the bears as the Russell 2000 fell 3 percent. Growth stocks were on the up, though, with the Innovator IBD 50 ETF ( FFTY ) down just 0.5%.

Stock market today: Hot inflation scares

One of the draws for stocks on Wednesday was the latest consumer price index, which came in hotter than expected. The news fueled inflationary concerns and hurt prospects for a rate cut in the near future.

Headline CPI rose 3.5% year-on-year. This was higher than the 3.4% observation. Core CPI, which strips out food and energy prices, rose 3.8 percent from a year earlier. It was also higher than analysts’ expectations.

Also on the economic front, minutes from the Federal Reserve are due after Wednesday. As traders bet on interest rate cuts, investors will focus on the latest minutes after they are released, looking for more policy clues.

Meanwhile, the 10-year Treasury note edged up 19 basis points to 4.55 percent while the 30-year yield rose 13 basis points to 4.63 percent. The five-year yield edged up 23 basis points to 4.61 percent, while the two-year Treasury gained 22 basis points to 4.97 percent. Yields were pushed even higher in afternoon trade after a 10-year disappointing auction.

Dow Jones Today: Home Depot, Intel Stocks Break

The Dow Jones fell more than 500 points. This equates to a decrease of more than 1.3 percent.

Home Depot (HD) was the laggard as it fell more than 3.2%. Intel ( INTC ) faced similar struggles, as the chip giant sank 3.1 percent. The struggling semiconductor stock is trading below its 200-day line.

Cisco Systems ( CSCO ) was the biggest loser early on and was down about 2%.

There were only a few components in positive territory on the Dow Jones today. Walmart ( WMT ) was the best performer, up just under 1%.

Magnificent Seven: Nvidia Rises Amidst Correction

It was shaping up to be a mixed session for the so-called Magnificent Seven in the stock market today.

Nvidia stock, buoyed by AI excitement, was trying to fight back after turning into correction territory. It rose more than 1% and further cleared the key 50-day moving average. It got a boost after Morgan Stanley raised its price target to 1000 from 795.

Nvidia stock fell into correction territory yesterday after it closed more than 10% below its March 25 high of 950.02. The standard definition of correction is a decrease of more than 10% but less than 20%. Even so, the leaderboard stock is up more than 70 percent so far in 2024.

Tesla stock was the biggest loser among the most watched group of stocks. Shares of the electric vehicle maker rose more than 3 percent, losing ground at the 50-day line in the process. This came after Jefferies cut its price target to 165 from 185 but maintained its hold rating.

Microsoft stock also lagged as it fell more than 1 percent, and is now testing buy support at the 21-day exponential moving average. The software giant is the world’s largest company by market cap, worth more than $3 trillion. An old rival apple ( AAPL ) fell nearly 1% as its downtrend continues. Google Parents the alphabet (GOOGL) fell partially.

Amazon.com (AMZN) inches lower while Meta platforms (META) broke out of negative territory and moved higher.

Stock Market Today: Deckers decked amid meltdown

Parent of the Ugg and Hoka brands Decker Outdoor ( DECK ) saw yesterday’s test of its 50-day moving average turn into a serious breach as it slipped nearly 8% on high volume, MarketSurge analysis shows. This is a key cell signal.

Deckers stock suffered after Truist downgraded the stock to hold on concerns of weak demand.

Aerospace games Hexel (HXL) signaled a sell as it broke below its 200-day moving average. Shares fell more than 11 percent in heavy volume.

Hexell’s stock fell after it was revealed that chief executive Nick Stange was retiring. He will be replaced by Thomas C. Gentile, effective May 1.

Homebuilder stocks were also under pressure. The iShares US Home Construction (ITB) exchange-traded fund is testing support at its 50-day line after falling more than 4%.

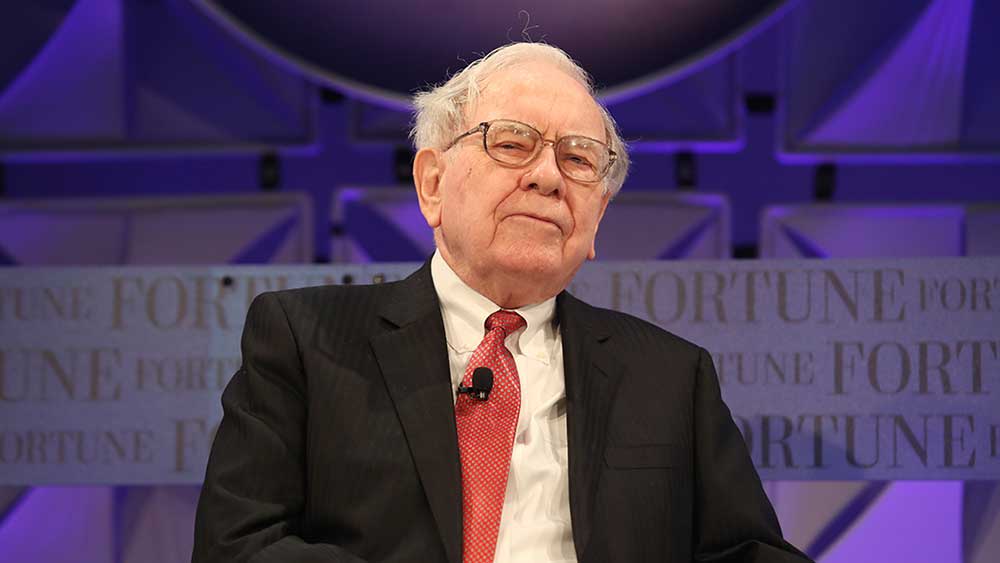

Warren Buffett Stock Flashes Sell Signal

Even the biggest investors can suffer painful losses. And legendary stock picker Warren Buffett might be spitting out his Coca-Cola today when one of the stocks he owns Berkshire Hathaway ( BRKB ) firm flashed a key sell signal.

Flooring and decoration (FND) broke below its 50-day moving average on above-average volume. The relative strength line is also falling. Its share price fell nearly 7 percent.

The flooring retailing company’s overall performance is not ideal, with its IBD Composite Rating coming in at 75 out of 99. And while it’s in the top 17% of stocks in terms of price performance over the past 12 months, the underlying performance isn’t great. Ideal This is reflected in its EPS rating of 66.

Even so, Buffett may choose to adopt his legendary buy-and-hold strategy because he still has a solid return on his average purchase price in the stock.

Outside the Dow: These stocks dig near entries.

Even amid tough action, some stocks were showing strength near buy points in the stock market today.

India-based Icici Bank slipped just below the 26.66 buy point of the early-stage flat base, market surge analysis showed. Nevertheless, shares were digging just below the entry. The stock regained its 50-day moving average in mid-February. Icici stock rallied in March as Asian bank stocks performed strongly.

Earnings performance is a highlight here, with an EPS rating of the best possible 99.

Exxon Enterprises is another one for investor watchlists as it climbed nearly 2% in the stock market today. Exxon continues to form a flat base with an exemplary entry of 325.63.

Exxon’s overall performance is strong, with its IBD Composite Rating coming in at 99. The police equipment maker is up more than 22 percent so far this year.

Please follow Michael Larkin on X, formerly known as Twitter. @IBD_MLarkin For further analysis of growth stocks.

You may also like:

12 Crazy Growth Stocks About to Blow the Doors Off

Here are the 5 best stocks to buy and watch right now.

Join IBD Live every morning for stock tips before the open.

This is the ultimate Warren Buffett stock, but should you buy it?

This is the ultimate Donald Trump stock: Is it a buy?