The technology sector is currently experiencing a renaissance as advances in artificial intelligence (AI) have sparked renewed investor interest.

Among the top AI opportunities is a small group of mega-cap tech companies collectively known as the “Magnificent Seven.” Over the past year and a half, the semiconductor company Nvidia (NASDAQ: NVDA ) 628% have returned — more than any other member of the Magnificent Seven.

Nvidia is undoubtedly playing a big role in the AI revolution, and its near-term prospects look very strong. But what about the long term?

Among his glorious seven companions, I see. Amazon (NASDAQ: AMZN ) As an excellent investment opportunity. Let's explore why Nvidia is on a roll right now, and examine the chipmaker's long-term prospects versus Amazon.

Nvidia is supercharged, but the competition continues.

Generative AI applications, such as training large language models, machine learning, and accelerated computing, rely on a few key components. That is, sophisticated semiconductor chips known as graphics processing units (GPUs), as well as data center network services, are integral to AI use cases.

Right now, Nvidia sits comfortably at the intersection of GPUs and data center operations. Currently, the company is estimated to have 80% of the addressable market for AI chips.

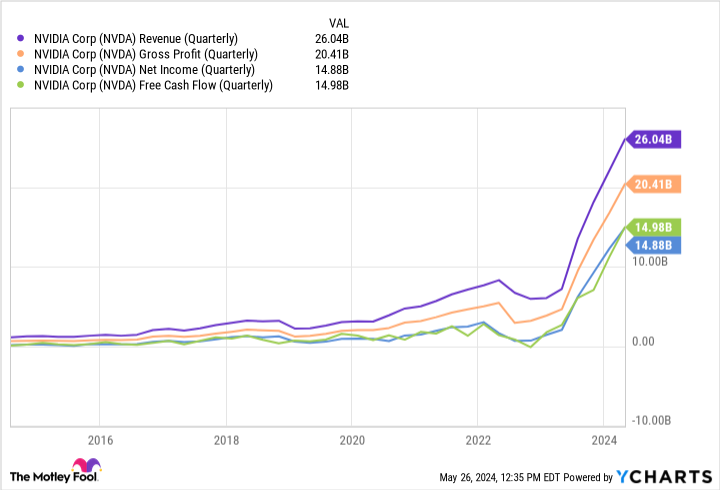

This commanding lead has translated into record revenues, margins and cash flow.

The slope of the lines in the chart above illustrates Nvidia's dominance. Demand for the company's chips and data center services is strong, and that has given Nvidia a lucrative source of pricing power. however, Advanced Micro Devices And Intel Developing a suite of alternative GPUs.

While neither company has anywhere near Nvidia's market share today, the long-term secular tailwinds fueling AI suggest there may be an opportunity to make up ground as Nvidia matches customer demand with supply output. The challenge is to match demand trends.

Furthermore, Nvidia faces competition not only from other chip businesses. Meta platforms and Amazon are both working on their own internally developed chips in an effort to move away from their reliance on Nvidia.

While I don't see any companies migrating away from Nvidia anytime soon, the long-term picture suggests that some of Nvidia's biggest customers may be a less important source of growth years from now.

Why I see Amazon as a better investment

Today, Amazon is best known for its e-commerce marketplace and cloud computing infrastructure — Amazon Web Services (AWS). However, Amazon has many other opportunities in its ecosystem, including streaming, grocery delivery, and advertising.

It's this diversified business that has me most bullish on Amazon's long-term prospects, as the company has a unique opportunity to expand its reach by integrating AI throughout its operations.

One of the most lucrative moves Amazon has already made is its $4 billion investment in AI startup Anthropic. Anthropic uses AWS as its primary cloud provider, and is training its creative AI models on Amazon's native chips.

Additionally, Amazon also recently committed $11 billion to build data centers — a move that I see as a big endorsement that the company is serious about moving away from Nvidia in the long run.

While the long-term benefits from these projects are likely years in the future, I'm optimistic that Amazon is laying the groundwork for sustainable growth. Looked at differently, while Nvidia is currently enjoying triple-digit revenue and profit growth, I doubt the company can sustain this momentum. On the other hand, I think Amazon is just scratching the surface of a new wave of services driven by aggressive ambitions featuring AI.

The bottom line

When it comes to choosing between Nvidia and Amazon, I don't think you can go wrong. Both companies are operating from strong positions, and each represents tremendous investment potential.

At the same time, Nvidia's stock price has risen sharply over the past two years. Given that competition remains in both data center services and AI-powered chips, I don't see Nvidia maintaining its lead. Ultimately, I think customers will expand their AI infrastructure and complement existing Nvidia services with other vendors.

In turn, this dynamic will result in lower revenue and profits for Nvidia in the coming years. By contrast, Amazon already boasts more than $50 billion in cash flow and $84 billion in cash and equivalents on its balance sheet.

Amazon is in a really good place, financially, and has the flexibility to double down on its AI efforts. As a result, I think Amazon will eventually overtake Nvidia in terms of value as it grows into a more sophisticated enterprise.

Considering the disparity between the valuation multiples, I would buy Amazon shares and plan to hold them for the long term. Nvidia is trading at a noticeable premium, thus suggesting that the stock may have some future growth. To me, Amazon's position in the AI realm is low, and the stock looks cheap right now. I would encourage investors to take advantage of this discount and continue to monitor the company's progress.

Should you invest $1,000 in Amazon right now?

Before buying stock in Amazon, consider this:

gave Motley Fool Stock Advisor The analysis team only indicated what they believed. 10 Best Stocks For investors to buy now… and Amazon was not one of them. 10 stocks that made the cut could generate monster returns in the coming years.

Consider when Nvidia This list was created on April 15, 2005… If you invested $1,000 at the time of our recommendation, You will have $671,728.!*

Stock Advisor Provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks every month. gave Stock Advisor There is a service More than four times S&P 500 Returns since 2002*.

View 10 Stocks »

*Stock Advisor will return on May 28, 2024.

John Mackey, former CEO of Whole Foods Market, is a member of the board of directors of The Motley Fool, an Amazon subsidiary. Randy Zuckerberg, former director of market development and spokeswoman for Facebook and sister of MetaPlatforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Adam Spotko has positions in Amazon, MetaPlatforms and Nvidia. The Motley Fool owns and recommends positions in Advanced Micro Devices, Amazon, MetaPlatforms, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short May 2024 $47 calls on Intel. The Motley Fool has a Disclosure Policy.

Prediction: These “Magnificent Seven” Artificial Intelligence (AI) Stocks Could Be Better Investments Than Nvidia Over the Next 5 Years was originally published by The Motley Fool.