gave S&P 500 (SNPINDEX: ^GSPC) It has returned 220% over the past decade, which is 12.3% compounded annually. This impressive performance was driven in large part by a single stock market sector.

To illustrate, the S&P 500 tracks the 500 largest U.S. companies, including value stocks and growth stocks from all 11 market sectors, as defined by the Global Industry Classification Standard (GICS). Those GICS stock market sectors are listed alphabetically below.

-

Communication Services

-

Consumer discretionary

-

Raw materials for consumers

-

Energy

-

Finance

-

Health care

-

industrial

-

Information technology

-

Content

-

of real estate

-

utility

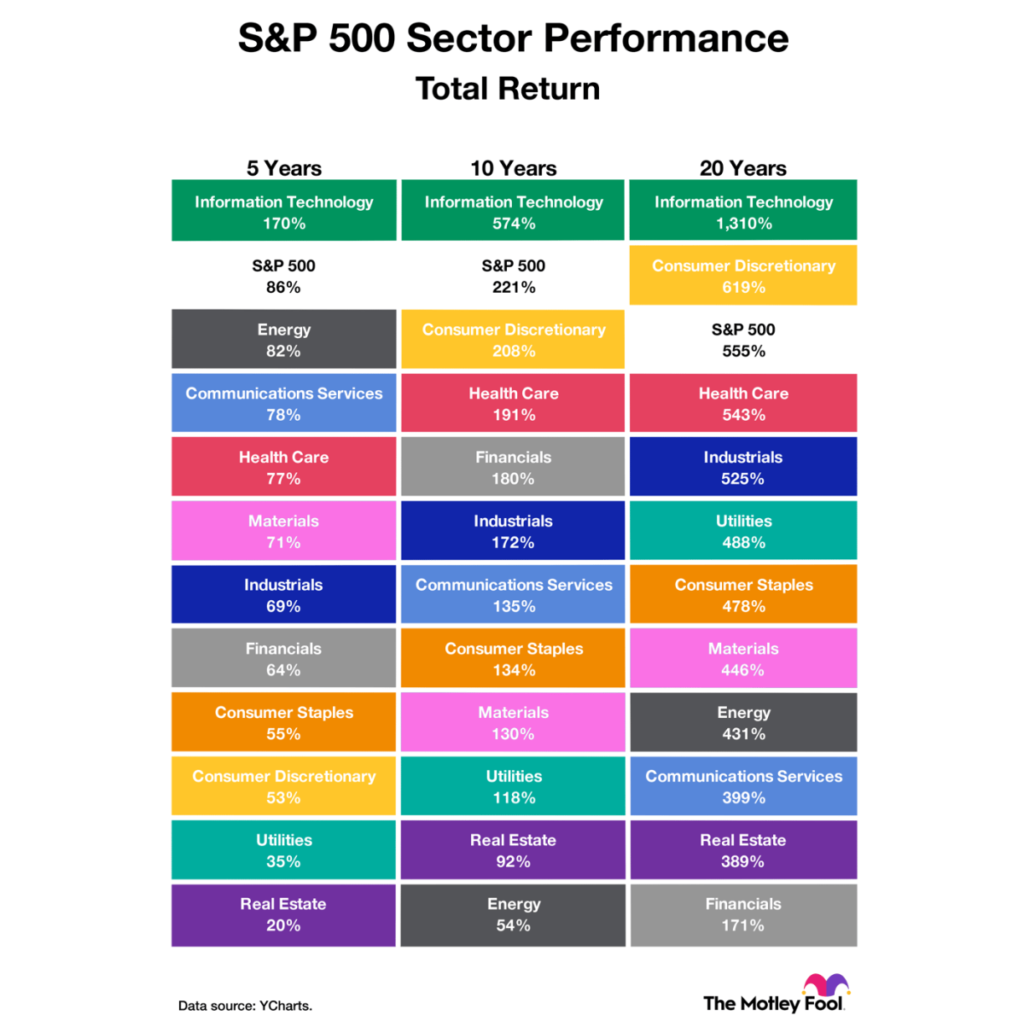

The field of information technology is somewhat unique for two reasons. First, it was the only stock market sector to beat the S&P 500 over the past decade. Second, it was the best performing stock market sector over the past five, 10 and 20 years.

This makes a compelling case for buying information shares Vanguard Information Technology ETF (NYSEMKT: VGT ). In fact, history says that an index fund could turn $250 a month into $873,700 over the next three decades. Read on to know more.

The information technology sector has consistently outperformed the S&P 500.

The Internet went mainstream in the mid-1990s, laying the groundwork for many of the technologies that have come to define the decades that followed. Among the most influential are mobile devices, e-commerce, cloud computing, cybersecurity, and software as a service.

These secular trends have kept the information technology sector ahead of the S&P 500 and other sectors of the stock market over the past five, 10 and 20 years, as shown in the chart below.

Going forward, many pundits believe that artificial intelligence (AI) will be one of the most impactful technologies in human history. Indeed, ex Microsoft CEO Bill Gates wrote the following in his blog last year: “Artificial intelligence is as revolutionary as mobile phones and the Internet.”

more recently, JP Morgan Chase CEO Jamie Dimon said artificial intelligence could be as revolutionary as the printing press, the steam engine, electricity, computing and the Internet.

Eventually, artificial intelligence will make its way into most sectors and industries. But technology companies — think chip makers, cloud providers, and software vendors — could be the biggest beneficiaries. In this context, AI could keep the information technology sector ahead of the broader stock market for decades to come.

An index fund that tracks stocks in the information technology sector.

The Vanguard Information Technology ETF tracks 313 technology stocks that fall into three categories: (1) software and services companies, (2) technology hardware and equipment providers, and (3) semiconductors and semiconductor equipment manufacturers. .

The 10 largest holdings in the Vanguard Information Technology ETF are listed below by weight.

-

Microsoft: 18.3%

-

apple: 15.4%

-

Nvidia: 11.8%

-

Broadcom: 4.2%

-

Sales Force: 2.1%

-

Advanced Micro Devices: 2.1%

-

Adobe: 1.7%

-

Accenture: 1.6%

-

Oracle: 1.5%

-

Cisco Systems: 1.5%

As noted above, Microsoft and Nvidia together make up 30% of the index fund by weighted exposure. Both technology companies could be big winners as artificial intelligence makes its way into more business and consumer products.

Indeed, analysts have Morgan Stanley Look at Microsoft as the software company best positioned to monetize creative AI. Similarly, Argus analysts recently wrote, “Nvidia stands out in our view, not only because it participates in many parts of the dynamic AI economy, but also because it has made its offerings unique. is the first type of AI-delivered in the cloud.”

Of course, other technology companies will benefit from artificial intelligence. In fact, many of the smaller stocks will likely outperform Microsoft and Nvidia by wide margins in the long run. In this context, the Vanguard Information Technology ETF is compelling because it allows investors to spread money across hundreds of technology stocks.

How the Vanguard Information Technology ETF Can Turn $250 a Month into $873,700

The Vanguard Information Technology ETF returned 1,160% over the past two decades, or 13.5% annually. This period covers such a wide range of economic conditions that investors can be reasonably confident of similar results (plus or minus a percentage point or two) over the long term.

Going forward, I will assume a slightly more conservative return of 12% annually. At this pace, a monthly investment of $250 in the Vanguard Information Technology ETF will grow to $57,500 in one decade, $247,300 in two decades, and $873,700 in three decades. However, this potential increase comes with a price.

The Vanguard Information Technology ETF has historically been very volatile. The index fund has a 10-year beta of 1.15, meaning it has moved 115 basis points (1.15 percentage points) for every 100 basis point move in the S&P 500 over the past decade. Similar ups and downs are likely in the future as well.

The last item of consequence is the expense ratio. The Vanguard Information Technology ETF has a relatively cheap expense ratio of 0.1%, meaning investors will pay $10 per year for every $10,000 invested in the fund. According to Vanguard, the average expense ratio on similar funds is 0.98%.

Should you invest $1,000 in the Vanguard World Fund – Vanguard Information Technology ETF now?

Before buying stocks in the Vanguard World Fund – Vanguard Information Technology ETF, consider this:

gave Motley Fool Stock Advisor The analysis team only indicated what they believed. 10 Best Stocks For investors to buy now… and the Vanguard World Fund – Vanguard Information Technology ETF was not one of them. 10 stocks that made the cut could generate monster returns in the coming years.

Consider when Nvidia This list was created on April 15, 2005… If you invested $1,000 at the time of our recommendation, You will have $505,010.!*

Stock Advisor Provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks every month. gave Stock Advisor There is a service More than four times S&P 500 Returns since 2002*.

View 10 Stocks »

*Stock Advisor returns on April 22, 2024

JPMorgan Chase Motley Fool Company is an advertising partner of The Ascent. Trevor Genwine has positions at Adobe and Nvidia. Motley Fool has positions in and recommends Accenture Plc, Adobe, Advanced Micro Devices, Apple, Cisco Systems, JPMorgan Chase, Microsoft, Nvidia, Oracle, and Salesforce. The Motley Fool recommends Broadcom and the following options: long January 2025 $290 calls on Accenture Plc, long January 2026 $395 calls on Microsoft, short January 2025 $310 calls on Accenture Plc, and short January 2026 $405 calls on Microsoft On. The Motley Fool has a Disclosure Policy.

This brilliant Vanguard ETF could turn $250 per month into $873,700 with artificial intelligence (AI) stocks Nvidia and Microsoft was originally published by The Motley Fool.