The excitement surrounding artificial intelligence (AI) cannot be understated. Technology stocks, in particular, rose in 2023, helping to propel it forward Nasdaq Composite by 43%.

Last year, a small group of mega-cap technology companies collectively known as the “Magnificent Seven” played a key role in driving the markets. However, many other opportunities outside of big tech are emerging as the AI revolution continues.

Shares of Palantir Technologies (NYSE: PLTR ) Last year there was a 167% increase. Additionally, Palantir stock was up 36% this year before it posted first-quarter earnings on May 6.

But since the company's earnings report in early May, Palantir shares have fallen 18%.

Is it time to buy the dip, or could Palantir be a falling knife? Let's take a look at the stock price volatility, and evaluate the company's earnings report.

A closer look at stock movements

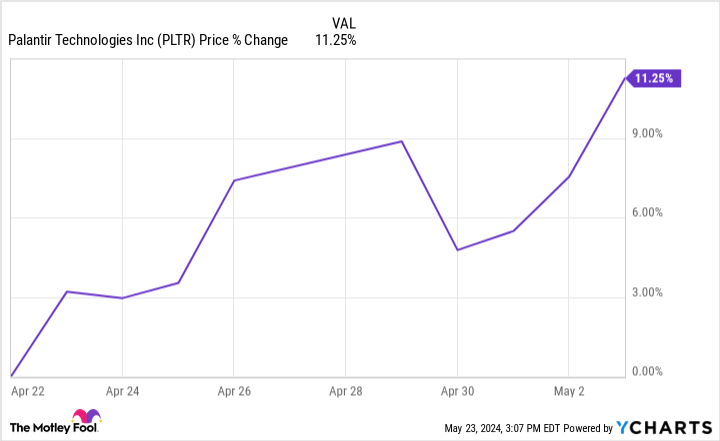

The chart below illustrates the movement in Palantir's stock price over the two weeks leading up to its first-quarter earnings report.

While 11% may not sound like much, it's a pretty dramatic movement in a short time frame. To put that in perspective, the entire Nasdaq index rose just 4.6 percent over the same period. Additionally, from January 1 to May 3, the Nasdaq gained 7.6 percent.

Considering that Palantir stock has beaten the Nasdaq's year-to-date performance in just two weeks suggests some depth.

That is, sometimes before an earnings report, a stock begins to observe some momentum. While there are many reasons for this, I would say that this large trading activity is not warranted most of the time.

Additionally, momentum stocks often come with risk because day traders can enter and exit positions in a flash.

Expectations are sky high.

Last year the stock market was heavily influenced by the spectacular investments that tech companies were making in AI. In other words, a lot of the AI narrative has been priced into software stocks in particular — even though many of these businesses haven't yet shown much for their AI investments.

In April 2023, Palantir released its fourth major software product: the Palantir Artificial Intelligence Platform (AIP). Since its release, Palantir has ignited a new wave of customer acquisition, driving impressive levels of revenue growth.

There's a lot of hype surrounding AIP, and Palantir has proven it can compete with big tech at a high level. Additionally, given that less than 50% of Palantir stock is held by major institutions, I think it's clear that the company has become a fan favorite in the retail investing community.

Palantir is moving the ball forward throughout its business. For the quarter ended March 31, Palantir grew revenue 21% year-over-year to $634 million.

Additionally, the company increased its operating margin from 24 percent during the first quarter of 2023 to 36 percent at the end of the first quarter of this year. The combination of strong revenue and rapidly expanding margins has resulted in consistently positive net income and free cash flow for Palantir.

Despite these positive indicators, Palantir stock has fallen sharply and prices continue to decline. Excitement surrounding the company's advances in AI led to a temporary period of increased buying activity. However, expectations from investors are now at a level that does not match reality.

To be clear, Palantir's current price action is currently showing signs of more similarity to meme stocks.

Is now a good time to invest in Palantir stock?

Despite some of the stock's quirks, I see many reasons to invest in Palantir.

AIP has proven to be a new source of growth for Palantir – particularly in the private sector. During the first quarter, the number of the company's US commercial customers grew 69% year-over-year. Additionally, the company is entering into strategic alliances with major technologies.

Palantir recently partnered. Oracle To bring your data to Oracle's cloud infrastructure. I see this as a profitable means of lead generation, and one that has yet to be recognized in Palantir's current results.

At a price-to-sales (P/S) ratio of 20.7, Palantir stock trades at a premium to many of its enterprise software peers and even to several large tech AI businesses. While this shows that Palantir shares aren't cheap, the trends seen in the chart above suggest that Palantir's valuation multiples have become more normal thanks to the selloff.

Even though Palantir stock is a bit expensive, I'd still consider scooping up the shares. The company has made measurable growth over the past year, and with growing sales and profitability Palantir represents a unique opportunity among high-growth AI software businesses.

Should you invest $1,000 in Palantir Technologies right now?

Before buying stock in Palantir Technologies, consider this:

gave Motley Fool Stock Advisor The analysis team only indicated what they believed. 10 Best Stocks For investors to buy now… and Palantir Technologies was not one of them. 10 stocks that made the cut could generate monster returns in the coming years.

Consider when Nvidia This list was created on April 15, 2005… If you invested $1,000 at the time of our recommendation, You will have $697,878.!*

Stock Advisor Provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks every month. gave Stock Advisor There is a service More than four times S&P 500 Returns since 2002*.

View 10 Stocks »

*Stock Advisor returns on May 28, 2024

Adam Spatiko has positions in Microsoft and Palantir Technologies. The Motley Fool has positions in and recommends DataDog, Microsoft, MongoDB, Oracle, Palantir Technologies, Salesforce, ServiceNow, and Snowflake. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a Disclosure Policy.

Palantir stock is cratering, but the reason may surprise you (hint: it's not because of an artificial intelligence competition) Originally published by The Motley Fool